Why Cryptocurrencies Are Losing Capital

Retail Investors Are Leaving the Market

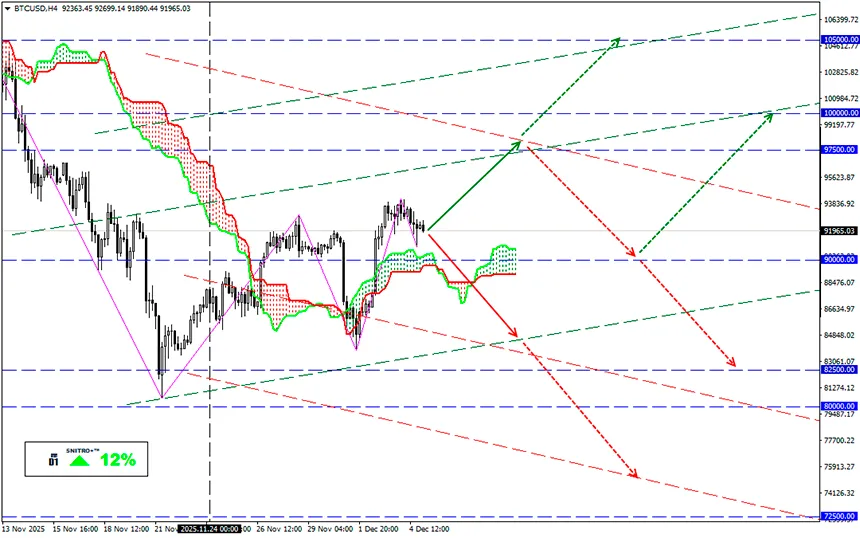

BTC/USD

Key zone: 90,000 - 93,500

Buy: 94,000 (on strong positive fundamentals) ; target 97,500; StopLoss 93,000

Sell: 89,500 (on a confident breakout of the 90,000 level) ; target 86,500; StopLoss 90,500

Losses from crypto-trader liquidations this year are estimated at $250–300 billion. Speculators with small and medium deposits are massively reallocating their remaining capital into other assets.

The MarketVector Index, which tracks a basket of 50 mid- and small-cap tokens, has crashed almost 70% this year, coming very close to its 2020 lows. Cryptocurrencies suffered the most during the autumn crisis that began in early October.

Derivative-trading volumes for small and mid-cap tokens on Hyperliquid fell sharply after the October crash. At the same time, activity on prediction markets such as Polymarket is setting new records. Robinhood is actively developing sports betting, while Gemini is preparing to offer prediction-market contracts.

The wave of marketing enthusiasm — which a year ago could pump anything from Trump’s wife to cat tokens — has long died. This year altcoins ignored fundamentally justified rallies and, after speculative spikes, dropped with acceleration. Even the well-capitalized Dogecoin fell 50% from September’s highs — and even Musk couldn’t stop it.

Prices no longer rise simply because new buyers appear. Investors now analyze tokens the same way they evaluate companies.

do they have users, revenue, or a working product?

Competition for retail money has become far more brutal. Zero-day options, speculative tech stocks, leveraged ETFs, and prediction markets offer both fast growth and adrenaline. Given that the market is flooded with thousands of small coins, such fierce competition is entirely logical.

Reminder:

Altcoins sit at the very edge of the market. They’re a mix of memecoins, DeFi experiments, governance tokens, etc. Most trade on low-liquidity markets with few real buyers. Their price depends on social-media hype, day-trader leverage, and other empirical factors.

But there are exceptions — BNB and HYPE consistently hold value because part of their revenue is used for buybacks and supply reduction — a crypto-equivalent of stock buybacks. Others, like Zcash, showed temporary sharp growth due to hype.

New speculation methods — stock-backed tokens or options-like derivatives — seem safer and more understandable. A new generation of blockchain-based assets now tracks real companies. They’re essentially crypto-versions of stock futures, allowing 24/7 betting on Apple, Nvidia, Tesla, and other giants. These products are early-stage, but show where small speculators are ready to move.

Of course, altcoins won’t disappear. The instinct for quick profit always finds new mechanisms — but the reliable support seen in previous market cycles is gone.

Switching from global problems to current market conditions.

Bitcoin is consolidating between $91,000 and $94,000 ahead of options expiry. The bullish impulse is weakening but not canceled. A strong trigger is required to break upward — and such a trigger may be today’s options expiry worth roughly $3.4 billion. The PUT/CALL ratio = 0.91, indicating a nearly neutral setup, but the exact number of contracts being closed is unclear — meaning the price may shoot in either direction.

So we act wisely and avoid unnecessary risks.

Profits to y’all!