Who benefits when the dollar suffers?

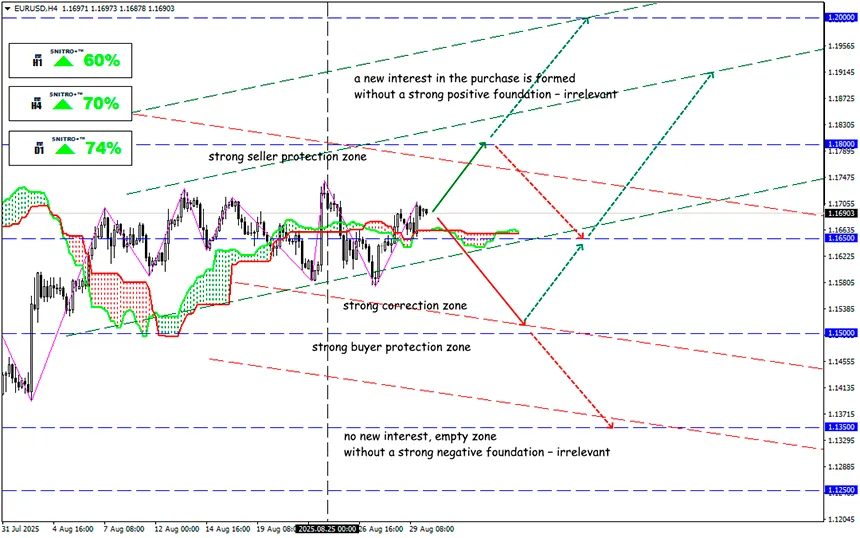

#EURUSD

Key zone: 1.1600 - 1.7000

Buy: 1.1750 (on strong positive fundamentals) ; target 1.1900-1.1950; StopLoss 1.1680

Sell: 1.1600 (after a retest of 1.1650) ; target 1.1450; StopLoss 1.1670

Wall Street expects the dollar to continue its decline this year, as the economy shows some signs of slowing and the Fed is ready to resume cutting interest rates. Powell at Jackson Hole stated he is prepared to take that step as early as the September 17 meeting.

The S&P 500 fell 0.3%, Nasdaq 100 – 0.5%. Yields on 10-year Treasuries rose 3 bps to 4.23%, the dollar strengthened 0.2%. Core PCE increased 0.3% m/m and 2.9% y/y – the highest level since February, complicating the Fed’s task ahead of the September rate decision.

Last week’s published PCE inflation index rose in line with expectations.

Reminder: this indicator is calculated in a very tricky way. The main difference between PCE and CPI is that it accounts not for a fixed consumer basket but a “real” one. If people abandon expensive products and switch to cheaper goods, PCE will not rise. And then analysts can claim inflation is defeated.

Therefore, when PCE comes in worse than forecast, it shocks the markets.

The current U.S. PCE with the wording “in line with expectations” means inflation was exactly as high as economists predicted. It is also worth noting strong U.S. GDP data and weak labor market figures, which together provide a neutral signal, so this statistic had no effect on quotes.

Hence the market reaction: first short-term “joy,” then the realization that the Fed’s key inflation gauge has been rising at maximum pace for 6 months led to a sharp correction.

From the perspective of Fed rates, nothing has changed. The market has long priced in a September cut, though traders massively believe that if rates are lowered in September, the market will rise. Not at all.

The September cut is already priced in – the market tried to grow on this back in mid-August (after CPI), then played off the PPI dip at the end of August.

Now it is time to think about the Fed’s next meetings in October and December. Thus, the September 16–17 meeting contains only one hidden meaning: what will be the rhetoric in the press release and Powell’s speech.

If the market tries to rise on September Fed meeting expectations, it will be not because of a 0.25% cut, but on hopes for Powell’s dovish forecasts.

If the rate is not cut (CME probability of this scenario is only 10%), then a catastrophic collapse will follow.

The key trigger of the week will be NFP. If data continues to deteriorate, the Fed may cut rates several times.

We must also consider that U.S. employment dynamics are influenced not only by Trump’s anti-immigration policy but also by Elon Musk’s mass layoffs of DOGE civil servants. Until recently, dismissed government employees were still counted as employed. By fall, significant adjustments should be expected. This will be another blow to the U.S. dollar.

So we act wisely and avoid unnecessary risks.

Profits to y’all!