Geopolitics and Speculation: What’s Happening in the Oil Market

XTI/USD

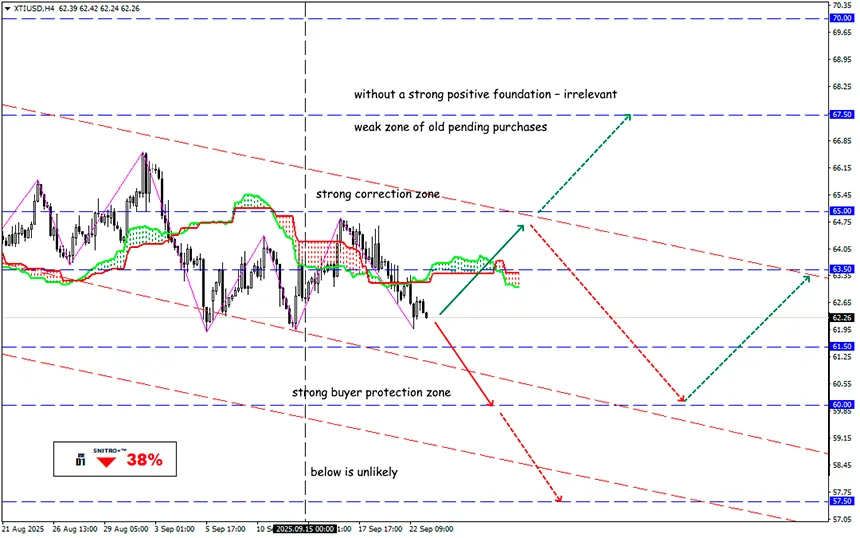

Key zone: 61.50 - 63.50

Buy: 63.50 (on strong positive fundamentals); target 65.50-67.50; StopLoss 62.80

Sell: 61.50 (on a pullback after a correction); target 60.00-59.50; StopLoss 62.20

Oil has become a distinct, highly efficient market where producers and buyers can easily trade massive volumes of raw material. This market processes an enormous amount of data. Any, even partial or temporary, “opacity” in information complicates analysis and leads to market prices misrepresenting the real balance of supply and demand.

There are two key factors the market is trying to ignore today: the volume of sanctioned oil and the scale of accumulated reserves. Add to this the risks associated with trade wars, and it becomes clear why oil prices have remained in a fairly narrow range for months — for example, $65–70 for Brent.

Despite constant verbal threats of oversupply, major players hesitate to place big bets when there is no unified view of the market’s fundamentals.

By the way, market forecasts differ significantly. The IEA expects consumption growth of 740K barrels per day in 2025, while OPEC projects growth of 1.3M barrels per day — a massive gap in estimates.

The China Factor

This year, China’s crude oil imports significantly exceeded refinery processing volumes — a clear sign of stockpiling. Over eight months, the average “excess” volume reached 990K barrels per day, nearly 1% of global demand.

This creates a mismatch between refining volumes and visible domestic demand. It either points to huge “blind spots” in Chinese market data or suggests that refineries are quietly building reserves of finished petroleum products.

Global Reserves

The main benchmark for the market has always been OECD stock data reported to the IEA. But today, China does not disclose its actual reserves.

According to analytics firm Kayrros, China added 73M barrels to its onshore storage since the beginning of the year, while OECD reserves rose only 40M barrels in the same period.

The “Shadow Fleet”

The picture is distorted by the use of uninsured tankers transporting crude from sanctioned countries (Russia, Iran, Venezuela). Together, these three produce about 13.5M barrels per day, or 13% of global supply.

These tankers create “blind zones” where buyers (e.g., India) conceal cargo origins. Since June 2022, China has stopped reporting Iranian oil imports in official customs data. The IEA is aware of the issue but leaves dealing with it to politicians.

Fundamentals are also supported by U.S. stock data and the Federal Reserve, which could boost optimism about U.S. economic growth and oil demand.

From a technical standpoint, both WTI and Brent are in consolidation zones. For WTI, support lies at $63.50–62.50. A steady move above $63.50 could reopen a path to retesting $65 and $67 resistance, while a breakdown below risks a decline toward $61.50–60.00. The balance of risks still leans toward buying, but there are no strong fundamentals for a rally yet.

So we act wisely and avoid unnecessary risks.

Profits to y’all!