What the market is screaming about

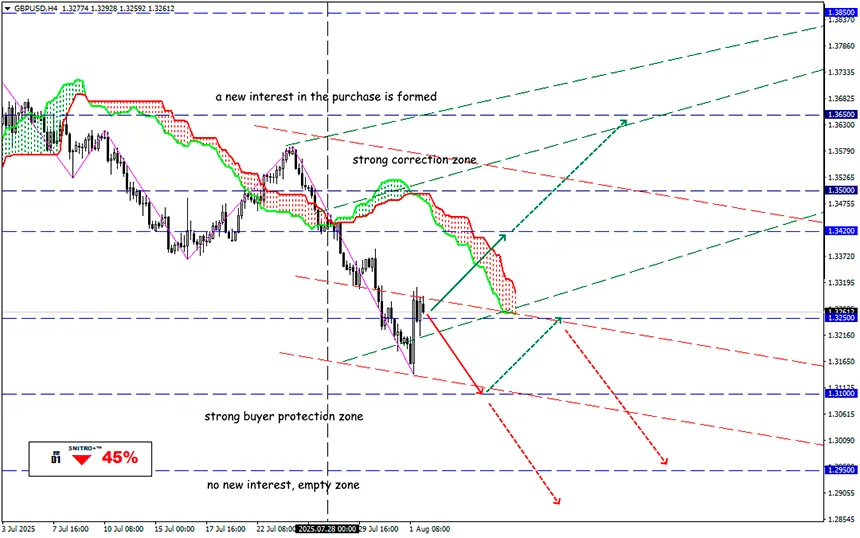

#GBPUSD

Key zone: 1.3150 - 1.3300

Buy: 1.3320 (after a retest of 1.3250) ; target 1.3500-1.3550; StopLoss 1.3250

Sell: 1.3150 (on a strong negative foundation) ; target 1.2950; StopLoss 1.3220

August began with a sharp 1.6% drop in the S&P 500, yet analysts still raised their Q3 earnings forecast for the S&P 500.

Recovery attempts remain weak. The market needs confirmation that tariffs are indeed raising prices and hitting American wallets. Overall, markets were pressured by several global factors:

• a new tariff salvo from Trump

• a scandalously weak NFP

• geopolitical rhetoric about nuclear submarines

• threats of reshuffling at the Fed

Incidentally, the head of the U.S. BLS has already been dismissed, and a Trump-loyal replacement has yet to be appointed. So now there’s no guarantee that U.S. statistical data will be truly honest.

Together, these factors pushed the VIX from <15 to ~20, bringing fear back to the market. August and September are traditionally the weakest periods for stocks, so the stream of apocalyptic headlines is intensifying.

Let’s recall the pressure points

The U.S. economy is cooling: there are fewer new jobs, and corporate momentum is slowing. The benchmark rate remains high, and hopes that the Fed may avoid a rate cut in September are the only support for equities.

Big Tech is too optimistic: reports from the “Magnificent Seven” drove indexes so high that the fall from here will hurt. Even as the AI craze shows all signs of a financial bubble, the top seven (Amazon, Microsoft, Google, etc.) still hold 30% of trading volume and drive the S&P 500.

Money is flowing into safe assets: U.S. bonds are back in demand — being bought, and yields are falling. There’s a subversive thought that big players are preparing for shocks and actively funding the “safe haven.”

This week’s earnings reports will reflect consumer behavior:

• McDonald’s (MCD) and Starbucks (SBUX): $5 combo breakfasts and fatigue from overpriced lattes will indicate the mood of the mass buyer.

• Reports from Uber, DoorDash, Airbnb will show if these "giants" can grow outside food delivery.

• Disney (DIS), Warner Bros. (WBD), Caterpillar (CAT), ADM, Palantir (PLTR), and Duolingo (DUOL) will test whether they are growth drivers outside of Big Tech.

There’s an idea that after the weak NFP, the Fed may already be ready to cut rates. But if earnings confirm that tariffs are seeping into prices, rates could fall even faster, supporting stocks — and stoking inflation fears.

And unless a new political short squeeze arises, the market will go back to “buying the dip.”

So we act wisely and avoid unnecessary risks.

Profits to y’all!