War of the Worlds: Exchanges vs. Crypto Treasuries

Who Controls Crypto Market Liquidity

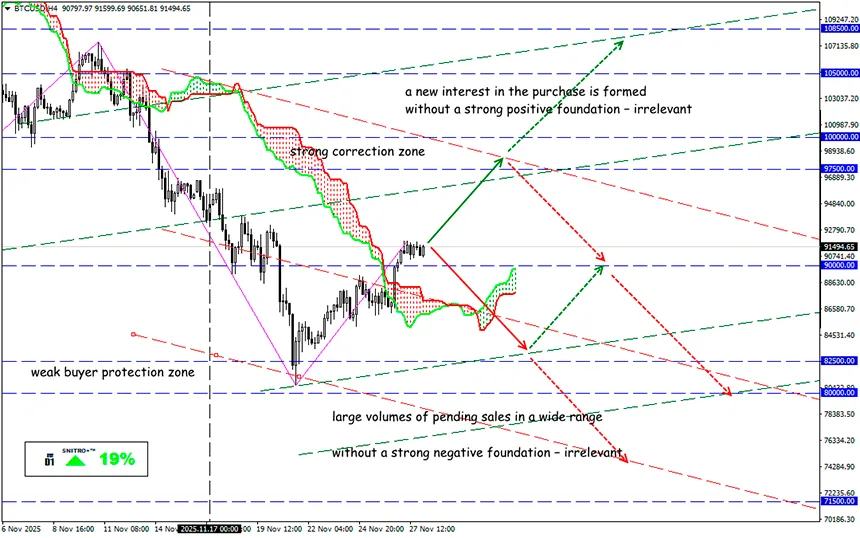

BTC/USD

Key zone: 88,000 - 93,500

Buy: 93,500 (after retesting the 90,000 level) ; target 95,500-97,500; StopLoss 92,500

Sell: 87,500 (on strong negative fundamentals) ; target 85,000-83,500; StopLoss 88,500

A seemingly illogical conflict is unfolding in the market. When a business (a company, fund, bank, etc.) purchases crypto assets legally and reports fully to investors and auditors, it represents an ideal model for a regulated market. Yet for some reason, it is the exchanges – intermediaries between traditional and digital capital – that actively block companies wishing simply to hold crypto on their balance sheets.

Three exchanges in the Asia-Pacific region – Hong Kong’s HKEX, India’s Bombay Stock Exchange (BSE), and Australia’s ASX – were the first to openly oppose the corporate model of crypto treasuries.

These entities manage risks, capital, and users in different ways – and increasingly find themselves on opposite sides of the table.

For example, India’s BSE recently denied Jetking Infotrain permission for a new share issuance after the company announced plans to invest part of its capital into cryptocurrencies.

HKEX has recently blocked at least five companies attempting to register as Digital Asset Treasuries – a new class of digital infrastructure that accumulates, allocates, and manages capital on-chain, supporting DAOs, L1 protocols, L2 networks, ecosystem funds, infrastructure firms, and token-issuing services.

In Japan, companies may legally hold bitcoin if they disclose it publicly. Among 14 such listed companies is Metaplanet, which has accumulated over $3.3 billion in BTC, becoming the symbol of corporate “HODL” in Asia. Yet even there, tension is rising: MSCI analysts have proposed excluding DAT companies from indexes because they behave like funds.

Stock-exchange listing rules prohibit excessive liquid reserves; therefore, such companies are classified as cash shells – legal wrappers with no real operations. For example, ASX in Australia allows public companies to hold no more than 50% of assets in crypto, making the crypto treasury model practically impossible.

It’s simple: an exchange is neither a bank nor a vault. Exchanges fear “dead money” because they survive on fees generated by capital flow. Crypto treasuries remove funds from circulation and lock them in cold storage.

Beyond that, new crypto treasury structures manage:

- project tokens;

- buybacks and burns;

- staking and reward programs;

- developer grants;

- DEX liquidity;

- real-yield revenue flows;

- ecosystem investments

But unlike exchanges, crypto treasuries do not show public liquidity – they manage the fundamental value of the token. A company must explain to investors why it needs BTC, for example, as part of its business logic rather than as an investment.

This is a conflict of different risk perspectives. For an exchange, liquidity is the goal; for a crypto treasury, liquidity is just an instrument. Exchanges do not like companies accumulating bitcoin because, for them, it’s not an investment – it’s exiting the game. Their fear is not volatility, but stability. Meanwhile, treasuries can crash a token price by increasing inflation or selling reserves.

Exchanges manage price and shape the short-term market; treasuries manage supply and shape long-term value. Understanding this balance is a crucial skill for any trader, especially when working with new tokens and low-liquidity assets.

So we act wisely and avoid unnecessary risks.

Profits to y’all!