Tragicomedy in the oil market: a new scenario

#XTIUSD

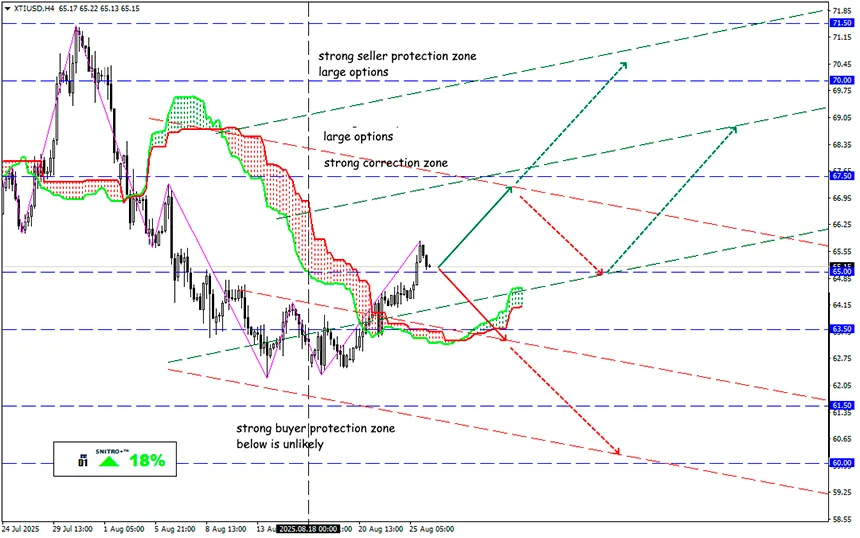

Key zone: 64.00 - 65.50

Buy: 65.50 (on a pullback after a correction to the 65 level); target 67.50-68.50; StopLoss 64.80

Sell: 63.50 (on strong negative fundamentals); target 61.50-60.00; StopLoss 64.20

The fact that OPEC+ would have to change its adventure of curbing production to support prices was clear to everyone, but such a sharp shift in the Cartel’s sentiment shocked speculators. The market had not seen anything like this even under extreme conditions, such as during the COVID-19 pandemic.

Instead of adding one hundred thousand barrels per day, in May OPEC+ accelerated sharply, and from September the “voluntary cuts” of 2.2 million bpd introduced in 2023 will be canceled.

Such a policy forced the IEA to raise its estimate of the global oil market surplus in 2025 to 1.7 million bpd, and in 2026 almost to 3 million bpd. Does OPEC+ really need a global price drop?

The cartel decided to scare competitors while increasing its own market share. Especially since new capacities are being actively developed — for example, in Saudi Arabia alone, new projects with production capacity of up to 650 thousand bpd are being implemented.

Arab oil has no intention of giving up the market to competitors outside OPEC+, primarily the US and Brazil. The fight will be serious: Saudi Arabia, for instance, can afford to push the price down to $40, or even lower in some scenarios, but no other oil can withstand this. The first victim will be US shale production. And Trump won’t help here.

When fundamentals are not enough to drive the market, geopolitics comes into play: military conflicts, sanctions, lawsuits, etc. For now, fundamentals are methodically pressuring prices, but geopolitical escalations will periodically scare the market, forcing speculators to urgently close shorts, and prices will show spikes of $10–15 in both directions.

OPEC is scheduled to hold a meeting on September 7 and approve another production increase.

Prices continue the dynamics of last week, as traders expect stronger US sanctions on Russian oil and Ukrainian attacks on Russia’s energy infrastructure, which could disrupt supplies. Risk appetite rose briefly after Powell’s speech, but that factor is already priced in. Currently, both benchmarks show no active dynamics — they are waiting for either political factors or the first signs of Trump’s tariffs affecting base fuel demand.

P.S. When demand normalizes, oil will calmly return to the comfortable zone of $80–100 per barrel. But right now it is being decided who will dominate the oil market at that moment.

So we act wisely and avoid unnecessary risks.

Profits to y’all!