Endless PUMP: The Fall Will Hurt

#BTCUSD

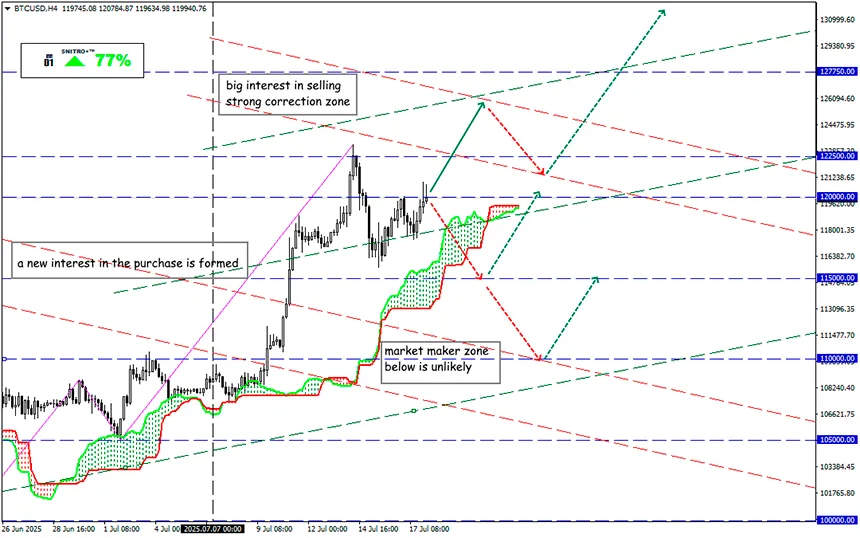

Key zone: 118,500 - 121,500

Buy: 122,500 (after a retest of the 120,000 level); target 127,500-130,000; StopLoss 121,000

Sell: 118,000 (on strong negative fundamentals); target 115,500-112,000; StopLoss 119,500

We are witnessing a perfect example of crowd manipulation: the growth scenario is unfolding on Trump speculation. Crypto opens every trading day with new upward impulses, pushing more people to believe in the infinite profitability of the PUMP.

Besides empty optimism, a new idea appeared in the information space – to open the U.S. retirement market to crypto. According to the Financial Times, Trump’s team is preparing a justification for crypto investments in retirement accounts (401(k) and IRA) – this could lead to an influx of hundreds of billions of dollars into the crypto market. In addition to private retirement accounts, BTC, ETH, and other assets may also be allowed in hedge fund pension portfolios.

If implemented, this initiative will serve as a solid foundation for legitimizing digital assets in the U.S.

This week, the market saw the first reaction to the idea of firing the Fed chair: following Bloomberg’s initial report, U.S. indexes, crypto, and DXY all dropped, while gold rose.

Trump underestimated the negative impact of this step. The Federal Reserve Act of 1913 contains a clause allowing the removal of the Fed chair "for cause". Under current circumstances, Trump cannot use it – any U.S. court would side with Powell.

Trump had to activate the TACO system again. He is now trying to find corruption charges against Jay to remove him. This certainly does not bring stability to the market.

For a confident reversal, traders must be discouraged from shorting – and no one knows how to do that.

The periodic withdrawal of large stablecoin sums from major exchanges suggests some profit-taking has already started.

Warnings of a looming correction are being ignored; capital inflow into buys continues, even though there are no logical TakerProfit levels in the market.

Signal data is valid until 25-07-25. Standard technical analysis must include open interest dynamics on major crypto exchanges. Technical correction is urgently needed and may occur in the next few trading days. New long positions may be opened on pullback with strict risk control.

So we act wisely and avoid unnecessary risks.

Profits to y’all!