Tariff War, Season III. The U.S. vs. the President

EUR/USD

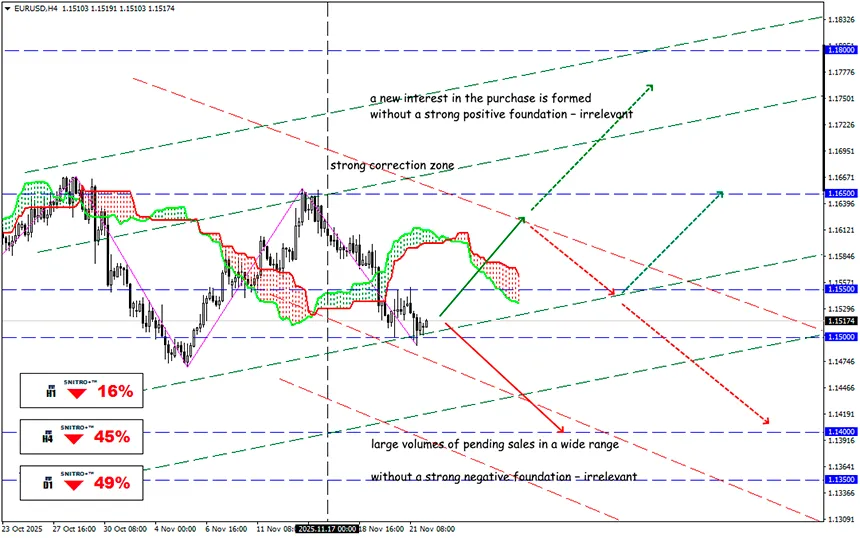

Key zone: 1.1500 - 1.1550

Buy: 1.1580 (after retesting level 1.16) ; target 1.1700; StopLoss 1.1520

Sell: 1.1480 (on strong negative fundamentals) ; target 1.1350; StopLoss 1.1550

The Trump administration is preparing backup options in case the Supreme Court strikes down one of its main tariff initiatives, trying to replace the duties as quickly as possible. These tools include Sections 301 and 122 of the Trade Act, which grant the president the authority to impose tariffs unilaterally.

Recall: The tariffs introduced in 2025 under the so-called “Liberation Day tariffs” were one of the largest adjustments to U.S. trade policy in decades. They covered nearly all categories of imported goods, imposing a base rate of 10% and increased duties of 11–100% against countries with “unfair” trade imbalances.

Trump also used Section 232 of the Trade Expansion Act to impose tariffs on sectors such as steelmaking and automotive manufacturing.

A federal appeals court has already deemed many of these measures illegal, stating that the president applied his IEEPA (International Emergency Economic Powers Act) authority too broadly and without sufficient justification.

The U.S. Supreme Court has opened a case to rule on the matter.

The White House is now preparing for a potentially unfavorable outcome after several justices voiced skepticism about global tariffs during this month’s oral arguments. Of course, the Court may uphold the tariffs, reduce them, or apply a more targeted framework.

If the Supreme Court ultimately overturns Trump’s tariffs, the consequences could be enormous — from U.S. budget recalculations to large-scale market movements:

- Loss of the legal foundation for the tariffs

- Mandatory refund of duties already collected: estimated hit to the federal budget is $750 billion to $1 trillion

- Consequences: worsening fiscal balance; rising deficit; Treasury borrowing restructuring; increased pressure on the bond market

- The refund and customs-procedure revision process may take a year or longer

Lower pressure from import inflation could shift expectations for interest rates.

The tariffs gave the U.S. a powerful negotiating tool against trading partners. If deemed unlawful, Washington’s leverage weakens, and partners may revise their own tariff measures and strategies.

The main beneficiaries of tariff cancellation will be retailers, electronics manufacturers, companies dependent on cheap imports, and logistics firms.

Those who lose: U.S. manufacturers who benefited from tariff-driven price advantages, the steel industry, and parts of the industrial sector.

Regardless of the Supreme Court’s decision, traders should watch for:

- Volatility — the ruling will be a major macro trigger

- Sector rotation — import-reliant firms benefit, domestic producers lose

- Fiscal risks — potential compensation payments will pressure the bond market

The next steps include analyzing reactions from Congress and the Treasury, countermeasures from China, the EU, Mexico, Canada, and other key partners, corporate supply-chain restructuring updates, inflation dynamics, and Federal Reserve outlooks.

This event should be viewed not as the end of the trade war, but the beginning of a new phase — more legally structured, but just as contentious and economically dangerous.

So we act wisely and avoid unnecessary risks.

Profits to y’all!