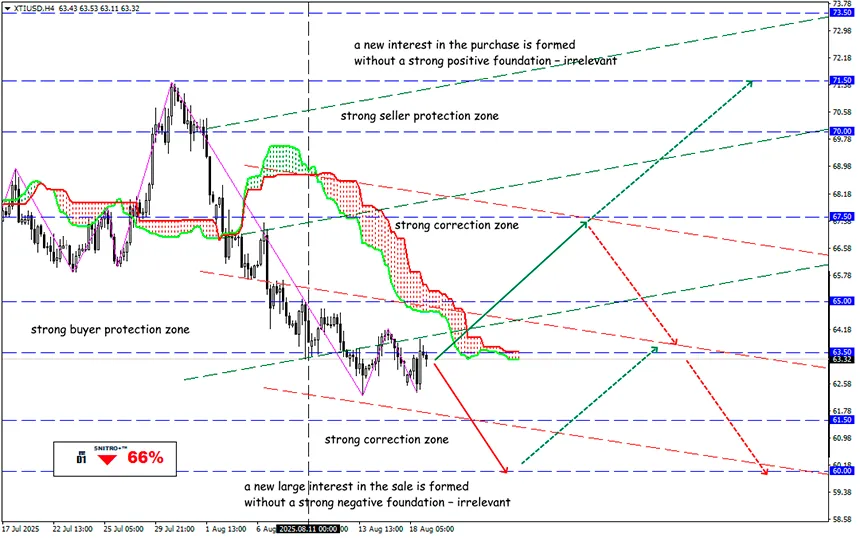

Oil Loses the Battle

#XTIUSD

Key zone: 62.00 - 64.00

Buy: 64.50 (on strong positive fundamentals); target 66.50-67.50; StopLoss 63.80

Sell: 61.50 (after a retest of 63.50); target 59.00; StopLoss 62.30

Brent, after a 1.1% rise in the previous session, fell closer to $66 per barrel; WTI hovers around $63. Pressure on quotes comes from forecasts of an expected supply surplus by leading analytical groups and the end of the summer season of increased fuel demand.

Oil prices declined as traders weighed the prospects of a ceasefire in Ukraine. Trump insists on a U.S.-Russia summit after high-level talks. Despite diplomatic efforts, attacks on both sides continue. On Monday, the Druzhba pipeline was shut down, and supplies to some Central European countries were suspended.

Any end to hostilities could increase supplies of crude oil from Russia.

However, oil prices are down more than 10%, mainly due to fears of U.S. trade policy consequences and expectations of oversupply as OPEC+ production volumes return.

Investors are closely monitoring how sanctions on oil supplies are evolving. Trump recently tightened economic sanctions against India for purchasing Russian oil, while sparing China and so far refusing secondary sanctions.

India acts as the global clearing hub for Russian oil: refining embargoed crude into high-quality exports while simultaneously providing Moscow with the needed dollars.

Trump’s trade adviser Peter Navarro urged India to stop buying Russian crude so the U.S. could treat it as a strategic partner. India’s combined tariff rate (50%) is among the highest of Washington’s trading partners.

The beneficiary of these complaints against India will naturally be China. If the U.S. tightens control over Indian purchases, Chinese refineries will benefit.

If the U.S. had demanded immediate compliance with sanctions, global oil prices could have jumped to $80 or higher, and Trump would not have tolerated that for long. He would have had to introduce a system of separate agreements to allow markets to adapt. This already happened in 2018, when a sharp price spike after sanctions against Iran forced Trump into a reverse policy now called TACO.

Now OPEC is unlikely to give Donald such a chance, but the potential for turbulence in the market remains. Yet the chances of a confident reversal upward are minimal.

So we act wisely and avoid unnecessary risks.

Profits to y’all!