Inflation vs. Jackson Hole: Whose Argument Is Stronger?

#XAUUSD

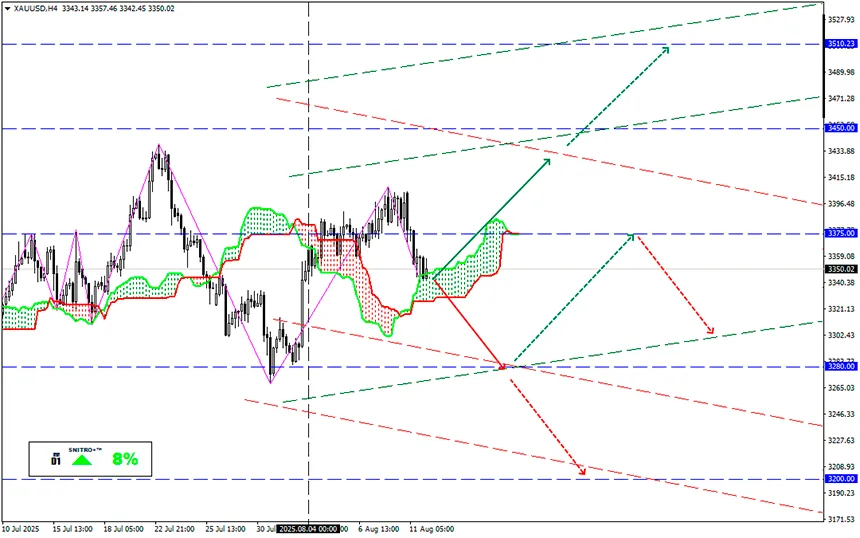

Key zone: 3,325.00 - 3,375.00

Buy: 3,375.00 (♪ after retesting 3330 ♪); target 3,600.00; StopLoss 3,300.00

Sell: 3,300.00 (on a strong negative foundation); target 3,150.00; StopLoss 3,350.00

Traders are trying to determine whether the impact of Trump’s tariffs can cancel the shift in monetary policy. Today we await CPI data, on Thursday PPI, and then Jackson Hole on August 21–23, where the Fed will have the stage to shape the September 17 meeting agenda.

Although the Fed’s dual mandate covers both employment and price stability, markets are focused on the inflation target set at 2%. Investors are watching for any signs that rising tariffs and production costs are filtering through to consumers. So far, the Consumer Price Index has missed forecasts for five consecutive months, but this streak may soon end.

The consensus for the core CPI is +0.3% m/m, which will lift the annual rate to 3%. For the market, this would be an almost perfect compromise: tough enough to keep rates steady, yet soft enough not to encourage fears of income deflation.

And let’s remember: the current political noise is not background, but a necessary condition in the risk premium. The market has received a new signal: the US–China tariff truce has been extended for 90 days, but the scandalous tension remains.

At the traditional Jackson Hole forum, the Fed usually carefully adjusts the markers. This year, the official theme of the symposium on August 21–23 is “The Labor Market in Transition.” Any hint of prioritizing employment over inflation will be read as a green light for a September rate cut.

Despite the rebound in stock markets, spot gold prices and gold futures fell more than 1% on Monday, wiping out last week’s gains driven by a weaker US dollar and softer data.

Hopes for a diplomatic thaw in the Ukrainian conflict have reduced demand for safe-haven currency, also causing silver to drop.

Technical resistance at $3400 remains key; a breakout could lead to new record highs for spot gold. Initial support is at $3335, and the next key target is $3300. A decisive close below $3300 will bring the June low of $3250 into focus and reverse the price direction.

So we act wisely and avoid unnecessary risks.

Profits to y’all!