How the Bank of Japan Is Killing the Yen

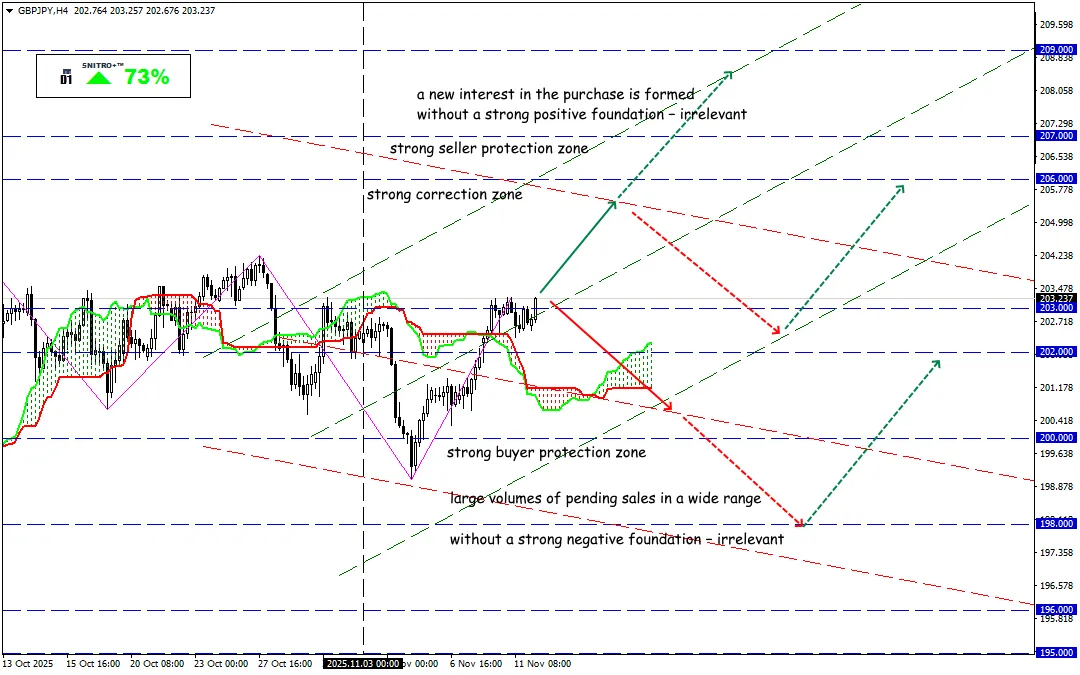

GBP/JPY

Key zone: 202.00- 203.50

Buy: 203.50 (on a pullback after retesting the 203.00 level); target 205.00; StopLoss 202.80

Sell: 202.00 (on strong negative fundamentals) ; target 200.50-200.00; StopLoss 202.70

Uncertainty surrounding the monetary regulator’s policy keeps buyers away from the yen. Japan’s Prime Minister warned that if the Bank of Japan pursues the “wrong” policy, the country could once again slip into a deflationary regime.

On Monday, the regulator published its rare “Summary of Opinions,” revealing deep internal divisions within the board regarding the prospects for raising interest rates. Board member Nakagawa emphasized that the central bank intends to maintain a cautious approach in making new decisions.

The discussion is further complicated by differing assessments of how new administrative measures introduced by the new government will affect economic conditions and inflation indicators. Prime Minister Sanae Takaichi’s perceived inclination toward a soft monetary stance is adding pressure on the yen.

Several board members noted that U.S. tariff policy and rising corporate wages in Japan play a critical role in determining the timing of future rate hikes.

These statements have strengthened market expectations that the BOJ may delay rate increases, particularly as large-scale stimulus measures are being prepared, giving additional support to yen bears.

There also remains uncertainty over potential interventions by the regulator to curb further yen depreciation, creating added risks for investors and reinforcing a cautious stance as markets remain neutral.

Recent data show that current economic conditions may restrain consumer spending—weak domestic demand could cap inflation. A weak yen, however, continues to push up import costs and consumer prices.

Renewed optimism linked to the possible end of the U.S. government shutdown has become another factor limiting the yen’s appeal as a safe-haven asset.

On Tuesday, Japan’s Ministry of Economy acknowledged growing awareness of how higher inflation undermines household purchasing power and announced plans to mitigate its effects.

Today, the Asian currency market remains calm amid uncertainty about potential rate cuts, while the dollar is stable ahead of the likely resolution of the U.S. fiscal crisis.

Lingering doubts over the fate of Trump’s tariffs, now under Supreme Court review, have also weighed on the yen, which continues to decline not only against the dollar but also across major crosses.

With more than a month left before the December meeting, combined with ongoing political and policy uncertainty, the only factor that could cap yen losses for now is market anticipation of further Fed rate cuts.

So we act wisely and avoid unnecessary risks.

Profits to y’all!