How Europe Fed Trump Empty Promises

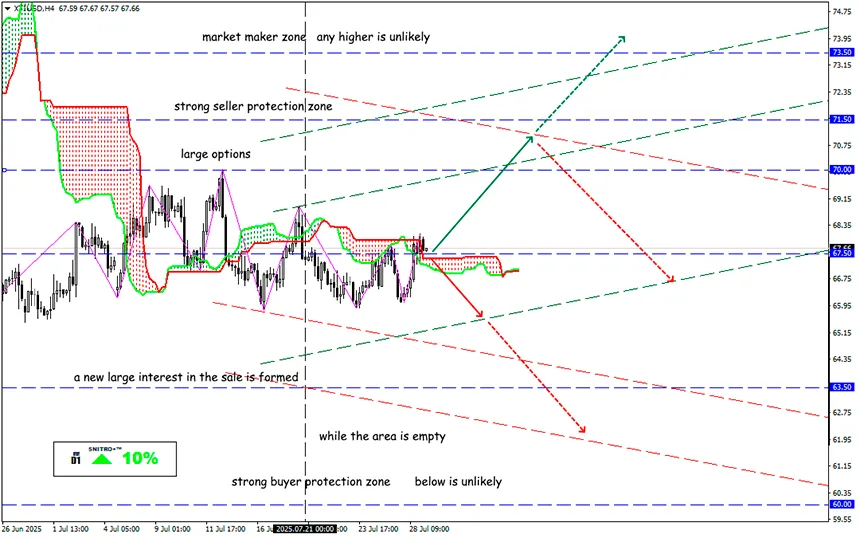

#XTIUSD

Key zone: 66.00 - 68.00

Buy: 68.50 (after a retest of 67.50); target 71.00-71.50; StopLoss 67.80

Sell: 65.50 (on a strong negative foundation); target 63.50-61.00; StopLoss 66.20

The term “preliminary” has finally made its way into the language of the EU–US trade agreement. In other words, there is no real treaty—no binding commitments. Still, Ursula von der Leyen managed to stage the scenario of taming the tariff aggressor.

On the surface, the deal looks like a real win for the EU, since they secured apparent gains on key issues. And they did it using Trump’s favorite tactic: promises. Just a reminder, the EU is expected to:

• Invest $600 billion in the U.S. economy

• Purchase $750 billion worth of energy over 3 years

Naturally, no one plans to fulfill these promises. The figures in the agreement are far removed from reality. For example, the EU currently buys around $60–70 billion worth of U.S. energy per year. Trump’s deal assumes the EU will purchase the entire volume exclusively from the U.S.—which contradicts the EU’s supply diversification strategy and is technically impossible

Also, nobody is talking about the obvious: the U.S. doesn’t even have that much energy to sell. In 2024, total U.S. exports of major energy commodities (oil, LNG, metallurgical coal) to all buyers combined did not exceed $165 billion. So how exactly is the U.S. going to sell $250 billion per year to the EU alone?

Fundamentally, nothing will change—but both sides of the deal will start to feel the pain soon enough. A reminder: higher tariffs drive up prices, increase interest rates, and slow economic growth. In the end, Trump’s tariffs will be paid by American consumers—through surcharges on imported goods. But the political show? That went perfectly

Markets are still riding a short-term high because the real tariff war hasn’t started yet. S&P 500 futures rose 0.4%, but that move didn’t get any follow-through

Once Europe took a hard look at “the greatest deal of all time,” EURUSD fell into the key 1.16 zone. Oil jumped around 2% on speculation—but for entirely unrelated reasons, and the move is unstable

In our view, it’s too early to dream about a major correction across all assets. For now, the spotlight is on the Fed. Let’s see if old Jay can turn the market around.

So we act wisely and avoid unnecessary risks.

Profits to y’all!