Gold Seeks New Targets: Not the Time to Sell Yet

Gold outlook for 2026

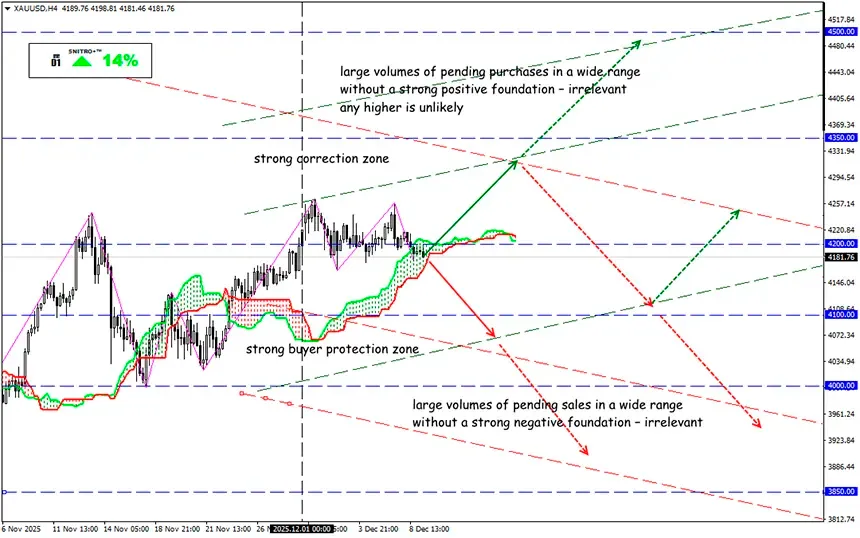

XAU/USD

Key zone: 4,150.00-4,250.00

Buy: 4,300.00(on a confident breakout of the 4.250 level); target 4,500-4,650; StopLoss 4,220.00

Sell: 4,100.00(on strong negative fundamentals); target 3,950-3,850; StopLoss 4,180.00

While markets await the Fed’s verdict, it is worth analyzing assets whose investment value is far more important than speculative momentum. Gold has shown extraordinary performance—over 60% growth since the start of the year. This rally was driven by geopolitical and economic uncertainty, but the main factor was still the weakness of the US dollar. The flight of capital into gold as a hedge against risk aligns with the strategy of major central banks pursuing diversification and stability.

According to the World Gold Council (WGC), the most likely scenario in current conditions is continued growth within a wide price range, though surprises remain possible. Depending on economic and geopolitical developments, gold may follow one of three trajectories: moderately bullish, sharply bullish, or bearish.

Scenario 1: Moderately optimistic

Market participants remain concerned about slowing economic growth, especially in the United States. Lower AI expectations and declining corporate profit forecasts could put downward pressure on equity markets.

This could lead (according to classical theory) to a weaker US labor market, reduced consumer activity, and a more pronounced economic slowdown.

A combination of further rate cuts, a weaker dollar, and heightened geopolitical risks could push gold 5–15% higher over the next 4–6 months.

Scenario 2: Extremely optimistic

A more extreme outcome is also possible: rising geopolitical tensions, trade wars, and regional conflicts could undermine global confidence and increase risk aversion. Businesses would sharply cut investment, consumers would reduce spending, and the Fed might act more aggressively—lowering long-term yields and pushing investors toward safe-haven assets such as gold.

In this case, prices could rise by 15–30% in 2026, driven largely by strong demand for gold ETFs.

Scenario 3: Negative

This assumes success in Trump’s fiscal and economic policies, boosting economic optimism and increasing inflationary pressure, which might force the Fed to halt cuts or even raise rates. However, Trump is unlikely to allow this.

A stronger US dollar would increase risk premiums across markets and reduce gold’s appeal.

Investors would redirect capital from gold to higher-yielding assets, causing outflows from gold ETFs. Under such conditions, spot gold prices could correct 5–20% below the year-end levels over 6–9 months.

Demand from central banks remains the key factor supporting gold. However, a risk emerges when gold is used as collateral for global credit—such as in India. In a crisis, forced liquidation of gold-backed loans would increase supply and push prices down, though it would take 2–3 months from the first warning signal to a global reaction.

Thus, the current price picture is deceptive—there are no strong negative global factors for gold yet.

So we act wisely and avoid unnecessary risks.

Profits to y’all!