Euro “Goes Digital”: Technology Transforms Finance

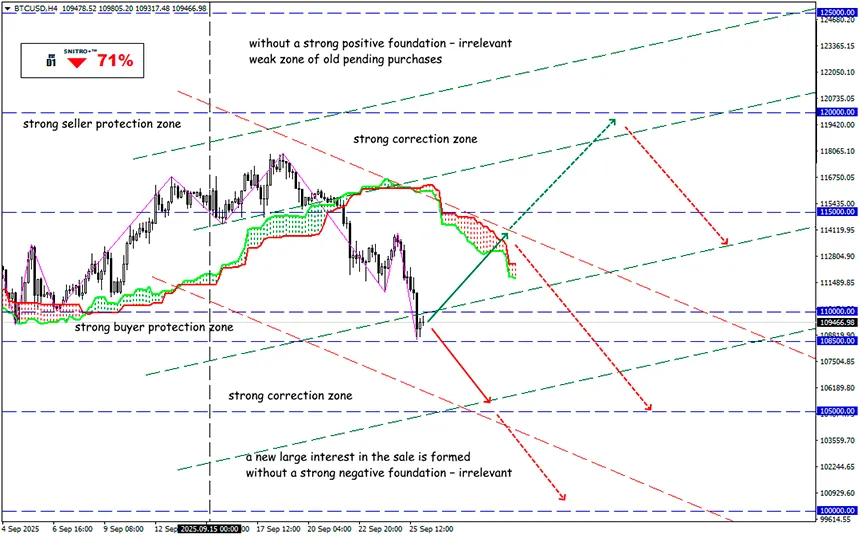

BTC/USD

Key zone: 108,500 - 110,000

Buy: 110,500 (on strong positive fundamentals); target 113,500-115,500; StopLoss 109,000

Sell: 108,000 (after a retest of the 110,000 level) ; target 105,500-103,500; StopLoss 109,500

The ECB is preparing for an ambitious project – the launch of the digital euro (CBDC), otherwise Europe risks becoming dependent on American or Chinese financial systems.

Nine European banks have united to issue a “stable” euro coin under MiCA legislation. The goal is to offer a competitive alternative to dominant U.S. stablecoins.

Participants include ING, Banca Sella, KBC, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International, though the project is open to both private and state investors.

A separate company registered in the Netherlands has been created to obtain an e-money license from the central bank. The token launch is planned for the second half of 2026.

The ECB will oversee the implementation of the euro stablecoin, while EU finance ministers will have a say in issuance and may set holding limits. Users will store coins in wallets managed by the ECB or intermediary banks. Payments will settle instantly, without Visa or Mastercard.

The digital euro gives the ECB direct control over money flows, even bypassing banks if necessary. For the regulator of 20 countries, this is a crucial tool for price stability.

The stablecoin segment is valued at $295 billion, dominated by U.S. Tether (58.6%), with Circle’s USDC competing (29.9%).

As of early 2025, ten issuers have obtained MiCA licenses to issue stablecoins in the EEA. Euro-based stablecoins are valued at $562 million, with the largest being EURC on Solana, launched by Circle in December 2023.

Key risk: privacy. Europe values strict data protection, but state digital currency raises fears of surveillance.

Second risk: commercial banks could lose deposits if millions shift funds into CBDC wallets. To protect liquidity, the first rule sets a cap of 3,000 coins per user.

For businesses, euro tokens reduce reliance on U.S. payment giants and lower transaction costs.

The euro stablecoin must balance innovation with caution. If it offers offline payments, instant cross-border transfers, and real privacy guarantees, it could become a truly popular option.

Whether this is a breakthrough or a failure – only time will tell.

So we act wisely and avoid unnecessary risks.

Profits to y’all!