Euro Attempts to Break the Trend

EUR/GBP

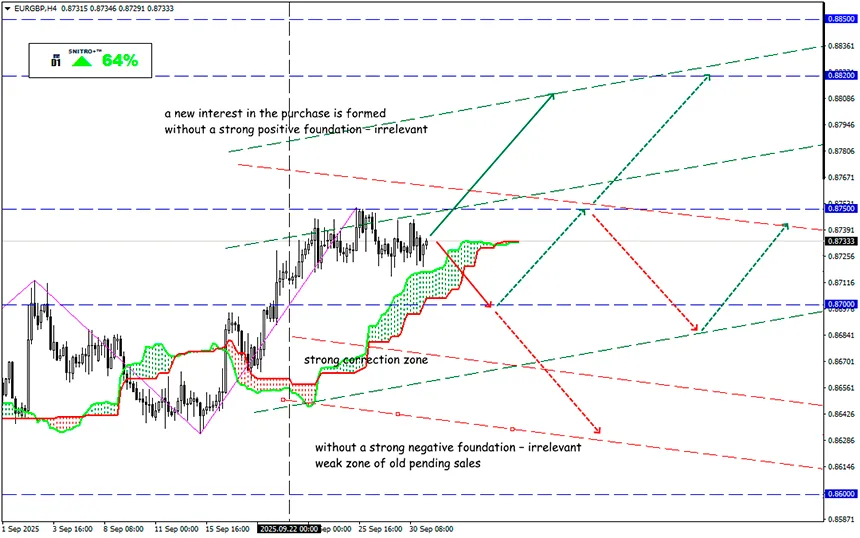

Key zone: 0.8700 - 0.8750

Buy: 0.8750 (on strong positive fundamentals); target 0.8850-0.8900; StopLoss 0.8680

Sell: 0.8700 (after a retest of 0.8750) ; target 0.8600-0.8550; StopLoss 0.8750

The fundamental backdrop for the European currency has been interpreted by the market as moderately positive for two weeks. Among the latest developments, the European Commission plans to:

- Raise import tariffs on foreign steel to levels comparable to U.S. and Canadian duties.

- Cut steel import quotas by nearly half as part of a new package of protective measures.

On ECB rate policy, there is nothing new: Chief Economist Philip Lane considers it unlikely that eurozone inflation will return to the low pre-pandemic levels. The probability of inflation significantly exceeding the 2% target is minimal.

This rhetoric suggests that the ECB has completed its cycle of monetary policy easing.

Conclusion: the rate differential between the ECB and the Fed will narrow, reducing the yield spread between U.S. Treasuries and German bonds (the EU’s leading economy).

Historically, this has always indicated euro appreciation against the dollar.

Nevertheless, no matter how strong the trend is, technical corrections are inevitable. The recent pullbacks in EUR/USD and major euro crosses were triggered by the closing of speculative longs after the Fed’s rate cut on federal funds, combined with a U.S. stock market decline and strong macro data.

However, once major capital absorbed the dip in the S&P 500 and FOMC members continued signaling further monetary easing, the euro started climbing again. As long as U.S. equity indices keep rising and the Fed continues cutting rates amid a cooling labor market, EUR/USD’s upside potential remains.

At the moment, the euro is advancing ahead of eurozone inflation data. Yet it is unclear how positively European capital will view the fact that German inflation has been rising for two consecutive months.

GBP/USD rose 0.2% to 1.3474, with sterling strengthening after a Nationwide Building Society report showed U.K. housing prices rose 0.5% in September following a 0.1% drop in August. The cross is not showing a clear reaction yet.

In any case, a U.S. government shutdown and dollar weakness are expected to dominate in the coming days, so all euro-linked assets anticipate a newupward impulse.

So we act wisely and avoid unnecessary risks.

Profits to y’all!