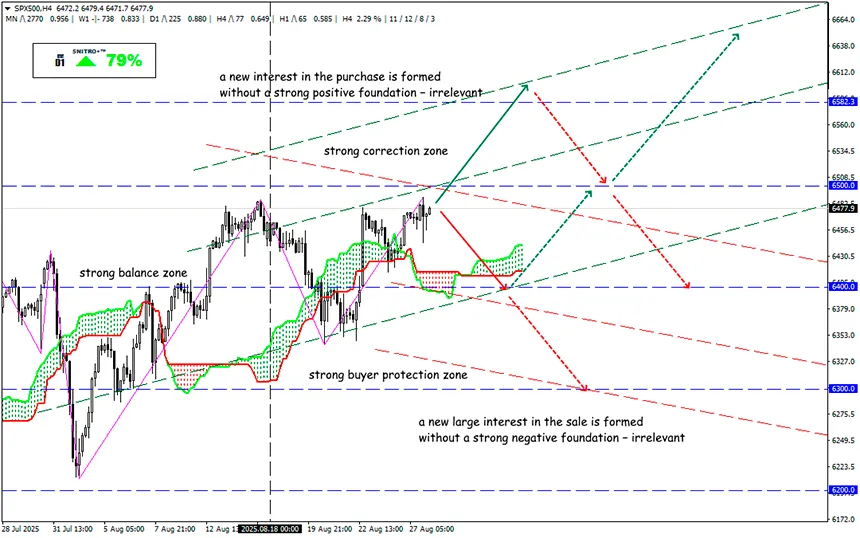

Catastrophe postponed for now

#SP500

Key zone: 6,400 - 6,450

Buy: 6,500 (on a pullback after a correction to 6,450); target 6,600-6,650; StopLoss 6,430

Sell: 6,400 (on strong negative fundamentals); target 6,250-6,200; StopLoss 6,470

The world’s most expensive public company keeps profiting from the AI frenzy, but after several quarters of spectacular results, the latest revenue forecast was seen as not impressive enough. Panic sellers appeared, convinced that demand for AI chips is stabilizing at the wrong time (and not profitably).

Nvidia’s financial results for Q2 2025:

- Total revenue: $46.7 billion (largely in line with forecasts).

- Data center revenue: $41.1 billion (+56%), but below expectations of $41.3 billion.

- Net income: $26.4 billion (+59% year-over-year).

For Q3, the company expects revenue of about $54 billion, slightly above Wall Street consensus.

Nvidia shares fell nearly 3% in after-hours trading due to the minor miss in data center revenue forecasts. This segment, which accounts for 89% of company sales, has disappointed expectations for the second quarter in a row.

Still, CEO Jensen Huang is confident that AI companies will spend $3–4 trillion over the next five years, and NVidia could capture up to 70% of that volume.

Nvidia’s stock price has nearly doubled since early April, when it had to close at a yearly low — below $95. At that time, Trump banned the company from selling H20 chips to Chinese clients, chips designed under US export restrictions.

Lower-than-expected data center revenue was partly the result of a $4 billion drop in H20 sales. After Huang’s visit to the White House and his promise to give 15% of AI chip revenue from China to the federal government, sales resumed. Still, NVidia’s future in China remains very uncertain.

To improve market sentiment, Huang used the standard tactic for such cases: he announced a buyback — immediately worth $60 billion, a record for NVDA (the previous buyback program “cost” $50 billion). Even for a company with a market cap of over $4.4 trillion, that is a huge amount. Market capitalization is an empirical notion, not “real” money. But $60 billion is a real repurchase of shares at current prices. That’s why the stock fell in after-hours trading.

Crypto, on the other hand, welcomed NVDA’s buyback. Despite SP500 being in the red, major token quotes are trying to rise.

The company will continue focusing on improving data center efficiency. And whatever the reaction to the current Nvidia report, its leadership position is under no threat.

So we act wisely and avoid unnecessary risks.

Profits to y’all!