Capital is flowing back into gold

#XAUUSD

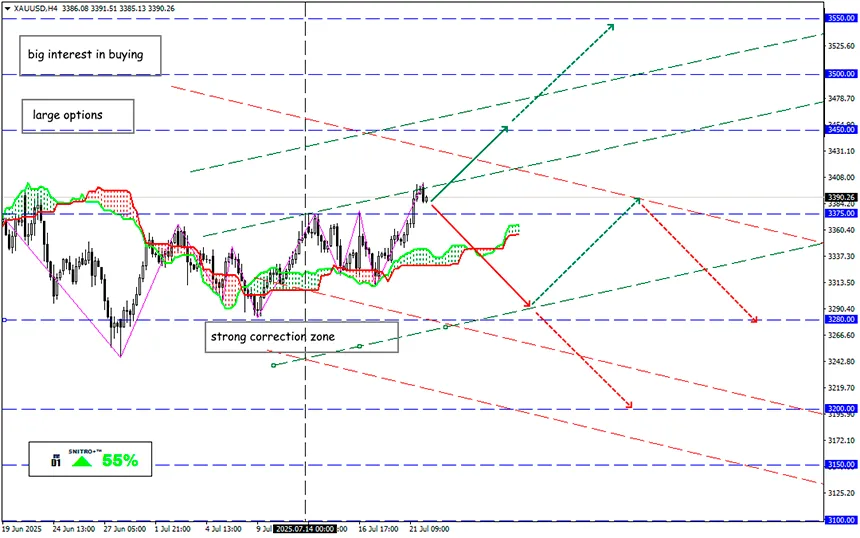

Key zone: 3,300.00 -3,400.00

Buy: 3,430.00 (on a strong positive foundation); target 3,550-3,600; StopLoss 3,350.00

Sell: 3,250.00 (after a retest of the 3,300 level); target 3,000.00; StopLoss 3,350.00

Gold opened the new trading week confidently and is once again testing the key level of $3400. For a decisive move into a higher trading range, serious (negative!) U.S. economic indicators will be needed. The date for Trump’s full-scale tariffs is approaching, and gold is searching for arguments for a new breakout.

The weakening of the U.S. dollar index has boosted demand for gold denominated in USD. Distrust in U.S. statistics supports gold prices, but breaking out of the range remains difficult.

This is understandable—gold is still supported by strong stimuli, especially as central banks continue to accumulate it in reserves. Heightened geopolitical tension, the risk of retaliatory tariffs from U.S. trade partners, and now concerns over the Fed’s independence will continue to support demand for precious metals (just look at silver’s insane rally!). The ECB monetary policy meeting this week may influence gold prices.

But the market has its own view. Gold shows firm growth only when the U.S. economy slides into a real recession. Once conditions normalize, gold drops rapidly.

The World Gold Council recently came to similar conclusions in its outlook: gold can rise significantly only if the Fed starts cutting rates aggressively—something that may only happen under tariffs if the U.S. economy comes to a halt.

There’s no shortage of negative indicators, but overall data still point to economic resilience in the face of new tariffs, supporting stocks to record highs. If this trend continues, gold may remain in a broad sideways range for another 2–3 months.

Gold prices are repeatedly facing pressure at the 3370–3360 range. However, a breakout above $3400 could trigger a new rally. In the absence of major macroeconomic data, continued weakening of U.S. bond yields and broad dollar depreciation are still supporting precious metals. That is why we are focused on buying.

So we act wisely and avoid unnecessary risks.

Profits to y’all!