S&P500: Can We Trust the New Bull Market?

SP500

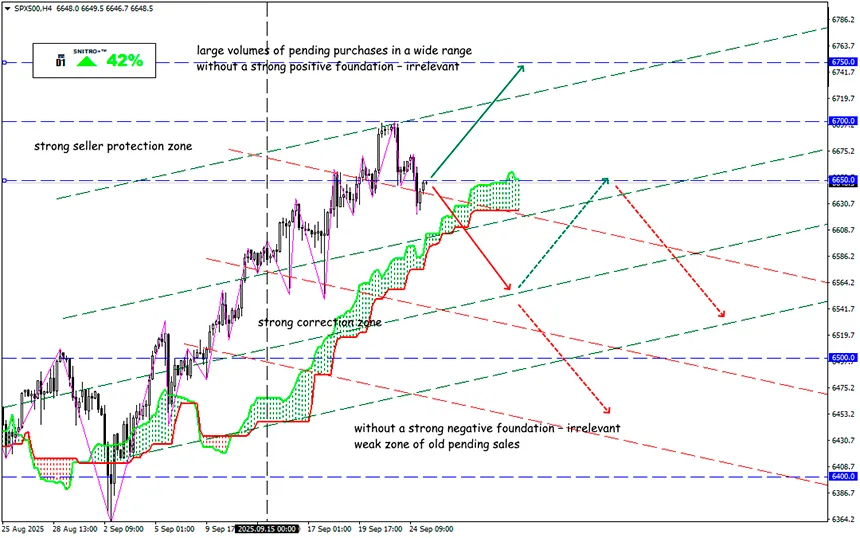

Key zone: 6,600 - 6,700

Buy: 6,700 (on a strong breakdown of 6,650); target 6,850; StopLoss 6,630

Sell: 6,600 (on strong negative fundamentals); target 6,450-6,400; StopLoss 6,650

The current market is a vivid example of the contradiction between expectations and reality. Stocks—especially technology and industrials—play a key role in how investors will allocate capital in the near future.

- Equity assets support the idea of continued growth, but most arguments are already priced in.

- The forward P/E ratio for the S&P 500 is 22–23x. In terms of the long-term trend, this is at historic highs. UBS analysts are confident this is one of the best readings since 1985.

- PMI data still point to growth, especially in manufacturing and technology.

- Earnings reports remain strong among large-cap companies, but mid- and small-caps have shown weak results, with many earnings estimates revised downward.

- Revenues of mid- and small-cap companies are already declining, as these firms are more sensitive to tighter financial conditions, supply chain disruptions, and weaker demand.

- Major AI companies are posting strong revenue growth, margin expansion, and positive forecasts, implying sustained investment demand.

- Optimism around earnings into late 2025 and next year is heavily overstated, and we must be ready for these estimates to be revised lower over the next few quarters.

Moreover, without buybacks, the market would trade about 40% lower than current levels. In 2025, buybacks are expected to exceed $1 trillion. Nevertheless, chances that the S&P 500 will reach or surpass 7000 by year-end 2025 remain very high.

From a technical perspective, the picture supports the bulls enough to prevent a steep decline in the near term. Yes, broad market indices are above key moving averages, but momentum remains positive.

The bullish case largely relies on AI, rate cuts, earnings growth, global liquidity, and strong capital flows. If these factors hold or improve, there is room for further gains.

At the moment, the equity market has not made a clear decision, so we should closely monitor core inflation components (wages, services, energy). Bulls have supportive factors in rate cuts, AI, and liquidity, but upside is capped. Future returns of popular stocks could be far below forecasts, and price action may prove overly volatile.

Bears also have compelling arguments—chronic overbought conditions, narrowing price ranges (many stocks lag behind the rally), rising macroeconomic instability risks (reviving inflation, weak labor market, supply chain disruptions), and geopolitical conflicts. Any misstep, such as an inflation miscalculation, a cautious Fed, or disappointing earnings, could turn the market downward, with drawdowns deep and prolonged.

So we act wisely and avoid unnecessary risks.

Profits to y’all!