Bitcoin: The Scenario Is Optimistic, but Problems Remain

#BTCUSD

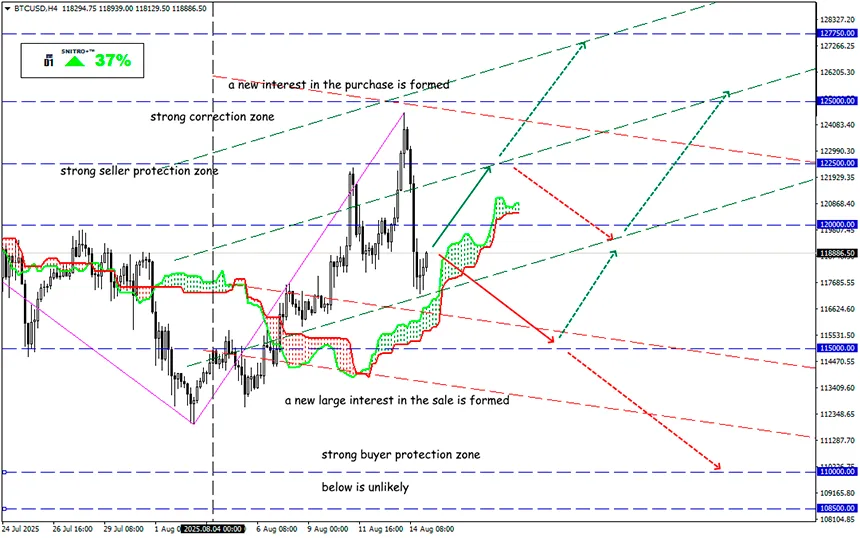

Key zone: 118,000 - 120,000

Buy: 119,500 (after a retest of the 118,000 level); target 122,500-124,000; StopLoss 118,500

Sell: 117,500 (on strong negative fundamentals) ; target 115,500; StopLoss 118,500

After updating the highs, retail players massively took profits, especially since in a morning Fox Business interview, Bessent once again stated that the U.S. Treasury does not plan to buy bitcoins for the strategic reserve on the open market.

In addition, Bessent repeated his earlier promises not to sell coins confiscated in civil and criminal cases that are in the process of being transferred under U.S. government control. The minister confirmed the modest amount of coins held by the U.S. government, equivalent to $15–20 billion, significantly less than earlier estimates of $23 billion.

Michael Saylor’s crypto pyramid continues to lose profit. Despite BTC’s rise, MSTR shares are trading about 25% below November 2024 levels and only 18% above the peak levels of 2000. On bitcoin’s confident uptrend, the failed method of endless additional issuances to raise money for buying the base asset logically began to generate losses. Even the much-hyped Monday bitcoin purchases are now for smaller amounts and not every week.

Strategy has become even more vulnerable to BTC price drawdowns. The company borrows money from all possible sources to buy bitcoin, influencing its rise. Declining attractiveness of MSTR shares will deter potential buyers of convertible bonds, reducing Strategy’s ability to organize another bitcoin pump.

Nevertheless, Saylor’s business model is now being actively copied. For example, Circle, which went public only on June 5, has already made an additional issuance. The company does not even bother with any “underlying asset” — it simply increases the number of shareholders in a Ponzi-like manner: as long as advertising brings a flow of contributors, they squeeze out every last dollar. In Circle’s case, everything is built on a scam principle, and at the moment the shares are in a sluggish downtrend. After TRUMP and MELANIA tokens, nothing is surprising anymore.

At the moment, sellers are defending the historical high at $123 000, buyers are holding the short-term uptrend line, but its breakdown may open the way to testing $118 000. On BTC/USD, a “Double Top” has formed, but deeper correction is not yet confirmed by large volumes. In the medium- and long-term perspective, the main scenario remains a continued move upward, with the next major target at $130 000.

So we act wisely and avoid unnecessary risks.

Profits to y’all!