America vs. Europe: The Tariff Battle

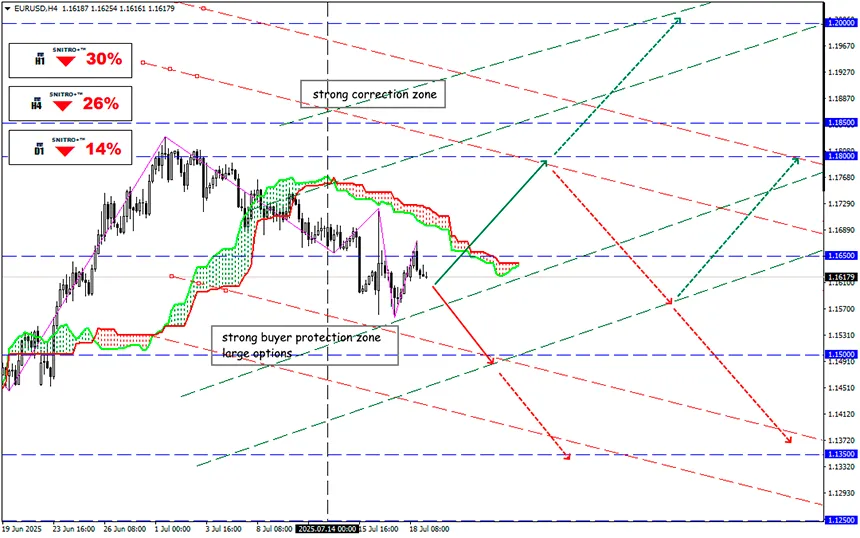

#EURUSD

Key zone: 1.1500 - 1.1700

Buy: 1.1730 (on a strong positive foundation); target 1.1850-1.1950; StopLoss 1.1650

Sell: 1.1550 (on a strong break of 1.16); target 1.1400-1.1350; StopLoss 1.1620

European Trade Commissioner Maroš Šefčovič delivered a grim assessment Friday of his recent talks in Washington with EU ambassadors. The U.S. hardline stance is another attempt to test the EU’s pain threshold after several weeks of failed negotiations over a 10% tariff on most goods.

The EU’s latest offer to reduce auto tariffs doesn’t impress Trump—he wants 25% as originally planned. The Trump administration is considering a reciprocal tariff exceeding 10%, even if a deal is struck.

Germany, represented by Chancellor Merz, traditionally voices general pessimism: Washington remains skeptical about sector-specific tariff relief. As an example, the U.S. has already imposed 50% tariffs on EU steel and aluminum.

Unless Trump lowers his aggression, the EU stands no chance of a successful trade deal with the U.S. Trump is determined to eliminate the EU's trade surplus, greatly increasing the risk of the bloc’s collapse.

Last week showed Trump cannot fire Powell, as the Fed’s alleged fraud in building renovations remains unproven. However, a U.S. court ruling that Trump’s dismissal of a Federal Trade Commission commissioner was illegal eliminates his last reserve of power in the war against the Fed chair. On July 31, the Supreme Court could even overturn Trump’s reciprocal tariffs, since this is Congress’s exclusive prerogative.

There’s little useful liquidity in the markets—crypto growth provides all the liquidity, and it’s now too tightly tied to the stock market. Any Bitcoin profit-taking triggers a stock decline, possibly signaling a fresh market “bubble.” A similar situation led to the 2008 mortgage crisis. But Trump only acknowledges the parts of history he likes.

Currently, all negotiations are entirely negative for the euro. Whether or not the EU signs a deal with the U.S., Europe is in a tough spot either way. Notably, the trend of relocating production from Europe to the U.S. is accelerating. However, if a deal is reached, a short-term upward correction in EUR/USD is possible until full deal details emerge—once the risks are fully understood, the euro will resume its decline.

European Commission President von der Leyen will visit China on July 24 for a high-level meeting. Positive details from this visit may help the euro hold current levels—but not for long.

So we act wisely and avoid unnecessary risks.

Profits to y’all!