A storm inside Europe doesn’t hurt the currency

#EURUSD

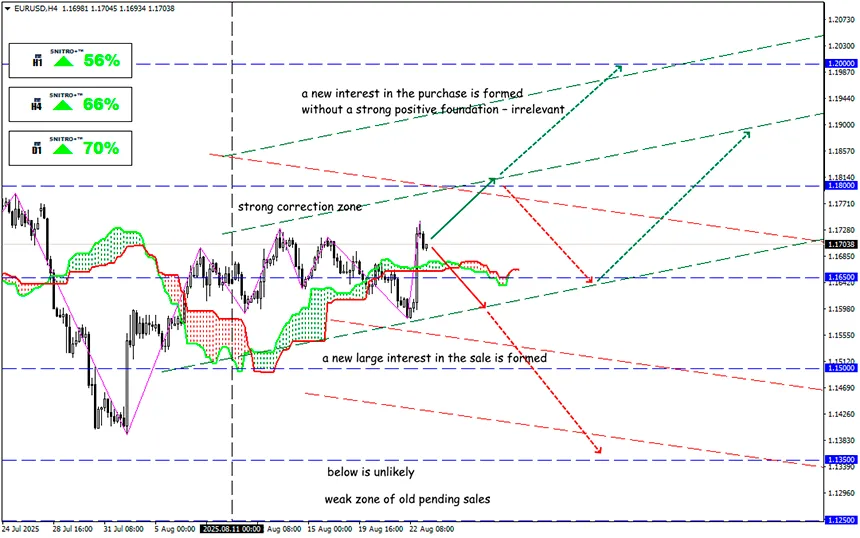

Key zone: 1.1600 - 1.1700

Buy: 1.1750 (on strong positive fundamentals) ; target 1.1900; StopLoss 1.1680

Sell: 1.1550 (after a solid breakdown of 1.16) ; target 1.1350; StopLoss 1.1620

The Eurozone suffers from geopolitical and economic risks. Strong Eurozone PMI data on Thursday caused a capital inflow into European assets, including the euro, but this movement quickly ended after the details of the US-EU trade deal were announced. Judging by the terms of the deal, the Eurozone economy faces an inevitable downturn.

Comments from former ECB President Draghi about the collapsed illusion of the EU as the world’s largest trading player and power already sound like an epitaph on the EU’s grave.

From the latest statistics, note Germany’s IFO Business Climate Index:

- July: 89.0 vs. 88.7 forecast and 88.6 previous.

- Current situation: 86.4 vs. 86.7 forecast and 86.5 prior.

- Expectations: 91.6 (forecast 90.2), previous 90.7.

The market viewed German data with skepticism after the sharp downward revision of Germany’s GDP.

The nervous dynamics of investor sentiment showed that large players lack understanding of the current stage of the economy and the future trend; they are ready to adjust portfolios at minimal deviations from forecasts, which indicates a high degree of fear and risk aversion.

On the European monetary theme, the following is clear:

- The ECB will likely keep rates unchanged in September, but if economic conditions worsen, it may return to the idea of further cuts before year-end.

- Trump’s tariffs on EU imports (currently 15%) were in line with ECB expectations and allowed avoiding worst-case scenarios, reducing the likelihood of an immediate cut.

- ECB forecasts allow for cuts, but discussions are planned no earlier than the October meeting.

- If new US tariffs appear that heavily hit exports and the defense sector, and the war in Ukraine drags on, the rate-cutting theme will return earlier.

All summer EUR/USD couldn’t decide on new highs before a serious drop.

There are still no strong fundamentals for euro growth, but if the new head of the US BLS, under Trump’s close control, shows creativity in the upcoming NFP data, market expectations may still push EUR/USD into the 1.1900–1.2100 zone. That’s where the fall will begin.

So we act wisely and avoid unnecessary risks.

Profits to y’all!