US Inflation: A Great Report or a Crisis of Confidence

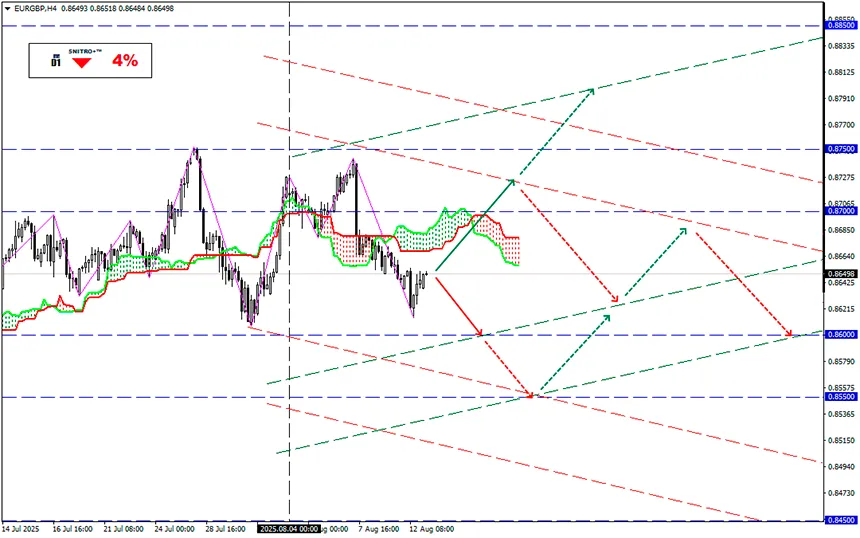

#EURGBP

Key zone: 0.8620 - 0.8660

Buy: 0.8680 (on strong positive EUR fundamentals); target 0.8780-0.8800; StopLoss 0.8630

Sell: 0.8600 (on a strong breakdown of 0.8620) ; target 0.8500-0.8450; StopLoss 0.8650

Yesterday’s US inflation report truly surprised the market.

Despite the highest import tariffs in the US in the past 50 years, inflation is barely accelerating.

Could it be that Trump was right?

Recall: last week Trump fired BLS Director Erica MacEntarfer after the latest Nonfarm Payrolls data was revised downward — quite significantly.

The dismissal was triggered by accusations of data falsification.

Of course, the current inflation figures might be entirely accurate and correct, but doubts about any future positive data on the US economy are growing.

Trump is eager to lower the Fed’s interest rate.

To achieve this, he would need either to replace Powell and half of the FOMC staff, “lower” the labor market data, or “adjust” inflation figures.

Removing Powell hasn’t worked so far, even considering the president’s intent to file a straightforward financial lawsuit against Jay.

However, the new BLS head, J. Anthony, according to Trump, “… will provide us with honest and accurate numbers.” Such statements from the president sound rather ambiguous.

The latest report shows inflation is not high enough to prevent a rate cut in September. But before the Fed meeting, there will still be another

NFP and an August inflation report. And August inflation will already be calculated by Trump’s protégé.

In fact, the first “wise” idea from the new BLS head is already out: “Until job data (NFP) is revised, the BLS should suspend the publication of monthly employment reports, but publish more accurate, albeit delayed, quarterly data.”

In other words, the traditional NFP should be canceled. Inflation reports and US GDP figures could also be withheld to avoid rattling the market — at least until the 2026 Congressional elections.

A great proposal, sure to please Trump. Official statistics can even show deflation, but it won’t win elections if consumers see real increases in retail prices.

We hope tomorrow’s PPI inflation report will still be released.

But there are several questions:

• On what basis will the previous NFP be “revised”?

• Who and how will determine the “accuracy” of future reports?

• And how can short-term market analysis be done without current labor market assessments?

There’s no one to answer these questions yet, but if our readers have suggestions — feel free to share.

So we act wisely and avoid unnecessary risks.

Profits to y’all!