XAU₮: Gold is more reliable than paper money

Why is Tether buying up gold?

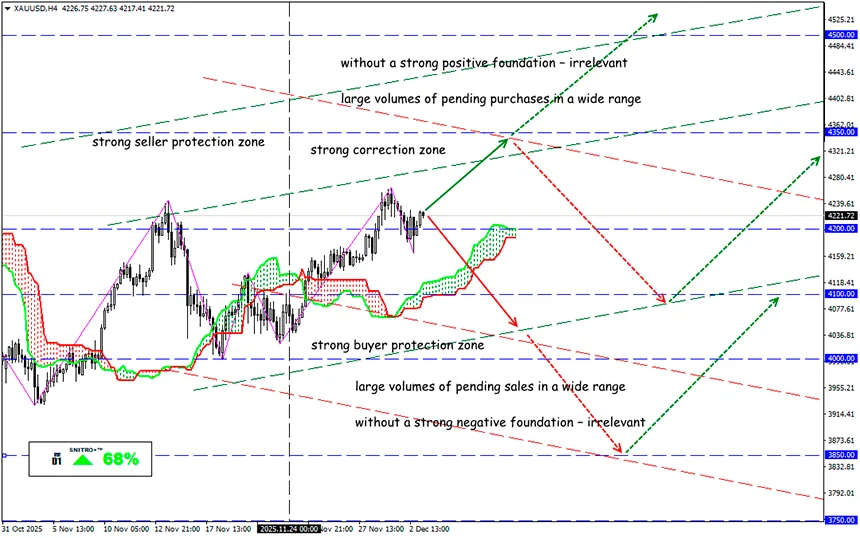

XAU/USD

Key zone: 4,200.00-4,300.00

Buy: 4,350.00(on strong positive fundamentals); target 4550-4650; StopLoss 4,250.00

Sell: 4,150.00(on a confident breakout of the 4.200 level); target 4,000-3,950; StopLoss 4,250.00

We live in an interesting world — we are constantly offered some kind of “new money”, yet in the end everything “new” turns out to be based on old, historically proven principles.

In Q3 of this year, Tether purchased 26 tons of physical gold — more than any central bank in the world during the same period. According to unofficial data, the crypto giant has accumulated around 116 tons of gold, becoming one of the largest non-sovereign holders of the metal — on the level of small central banks such as Greece or Hungary.

Central banks collectively buy around 1,000 tons of gold annually for the third year in a row. This makes Tether a major marginal buyer. At current prices, 116 tons equal more than $15 billion. Tether has issued $184.7 billion worth of USDT, meaning gold represents about 8% of its reserves.

Why does a crypto company — whose token has effectively become the global standard of electronic payments — need so much physical gold?

- Part of the gold backs Tether Gold (XAU₮), a token that grants the right to one ounce of physical gold stored in Swiss vaults.

- The rest represents investments in “hard assets” within Tether’s reserves (alongside Treasuries, cash, etc.).

- A political and legal hedge: gold in Switzerland (or other jurisdictions) is harder to freeze through sanctions than dollar accounts.

Tether’s market logic is approximately this:

- If capital flows out of Treasuries, Tether strengthens while simultaneously profiting by offering a gold-based digital product.

- The more popular gold becomes as a reserve asset, the easier it is to promote the idea: “USDT for liquidity, XAU₮ for capital preservation.”

Tether earns money from:

- fees for issuing and redeeming XAU₮;

- spreads from physical gold operations.

Thus, gold for Tether is not merely a “reserve” but a commercial product and a cash-flow generator.

Many are unhappy that Tether has begun buying volatile assets instead of Treasuries to back its tokens.

S&P Global has downgraded USDT’s stability rating to its lowest tier. And although S&P currently sees bitcoin as the main problem, gold is also listed among the risky reserve assets.

Tether CEO Paolo Ardoino called S&P’s methodology “a weapon of the outdated financial system.”

These purchases mean that inflows of fiat money into stablecoins now automatically direct part of those funds into gold — and the speed of this process is accelerating.

The rise of XAU₮ and the entire tokenized-gold market (XAU₮ + PAXG ≈ 90% of the sector) turns gold into a full-fledged element of crypto infrastructure, while Tether becomes a hybrid “ETF + custodian + USDT issuer” — which naturally raises concerns.

It is difficult to say whether this is good or bad for the average trader.

But as trust in the traditional paper dollar declines, its digital alternative is becoming gold-backed.

Thus, $5000 per ounce in 2026 may well become the norm — but the volatility of gold and other precious metals will become increasingly unmanageable.

So we act wisely and avoid unnecessary risks.

Profits to y’all!