The Asian Dragon Is Calm, and That’s Dangerous

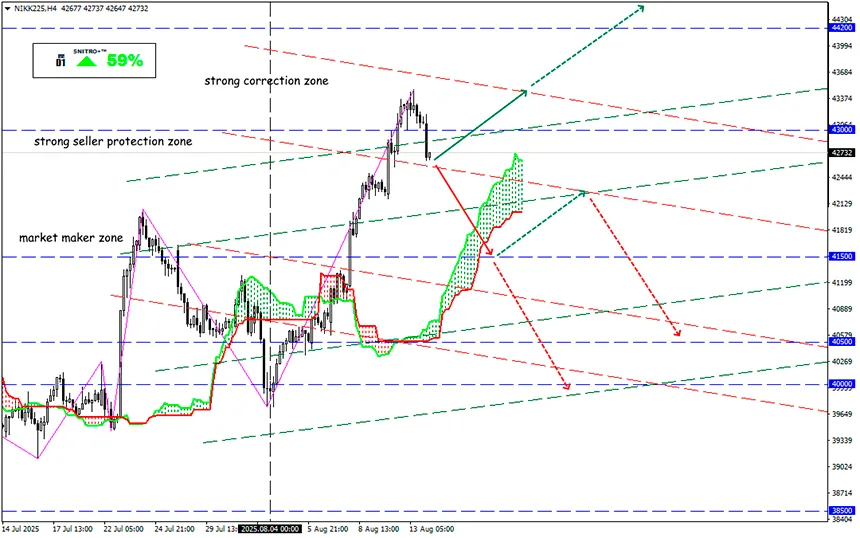

#NIKK225

Key zone: 42,200 -43,000

Buy: 43,300 (after retest of 43,000); target 44,800; StopLoss 42,800

Sell: 42,000 (on a strong negative foundation); target 40,500; StopLoss 42,700

Trump has extended the fragile US-China trade truce for another 90 days. Beijing is using this pause to sharpen its complex arsenal of destructive economic weapons. While Washington weighs a broader agreement (over $659 billion annually), Beijing is confidently striking at supply chains and the industries that depend on them.

In recent months, China has scored several victories. For example, in response to US tariffs, it cut off supplies of critically important rare earth minerals and magnets. The US auto industry (with a turnover of over $1.5 trillion) panicked, forcing Donnie to seek truce options. In July, the EU faced a similar situation, which became a subject of negotiations ahead of the EU-China summit.

Back in 2020, Beijing began building its own supply chains for industrial components to increase international manufacturing logistics’ dependence on China.

By Trump’s second term, Beijing had launched an export licensing system for more than 700 critically important goods and materials (arms, energy, electronics, biotechnology, pharmaceuticals, etc.). Now China can halt any export simply by revoking licenses. For example, licenses for supplying equipment to India — where Apple is building alternative supply chains — are no longer issued.

An extraterritorial jurisdiction mechanism is also in effect: Beijing has the right to demand that goods produced in third countries using Chinese components cannot be sold to certain end users.

By restricting the flow of industrial components needed for manufacturing, Beijing lowers domestic prices and gives its exporters a price advantage over foreign competitors in critical sectors. High tariffs force businesses to raise prices, but export controls push them to invest in alternative schemes.

Of course, there is a price to pay — for example, in the form of lost business reputation. Now businesses fear they could be suddenly cut off from Chinese suppliers, say, in the event of a conflict over Taiwan.

China has proven that the more sanctions there are, the less impact they have. At present, Beijing has convinced partners of the reliability of its supply chains while simultaneously using diplomacy to pressure potential counterparties against the US.

The export flow can be dynamically adjusted through sensible policy. But this complex, multi-factor scheme is something Trump simply won’t have time to understand.

So we act wisely and avoid unnecessary risks.

Profits to y’all!