Crypto Revolution: Fresh Money and a New Trend

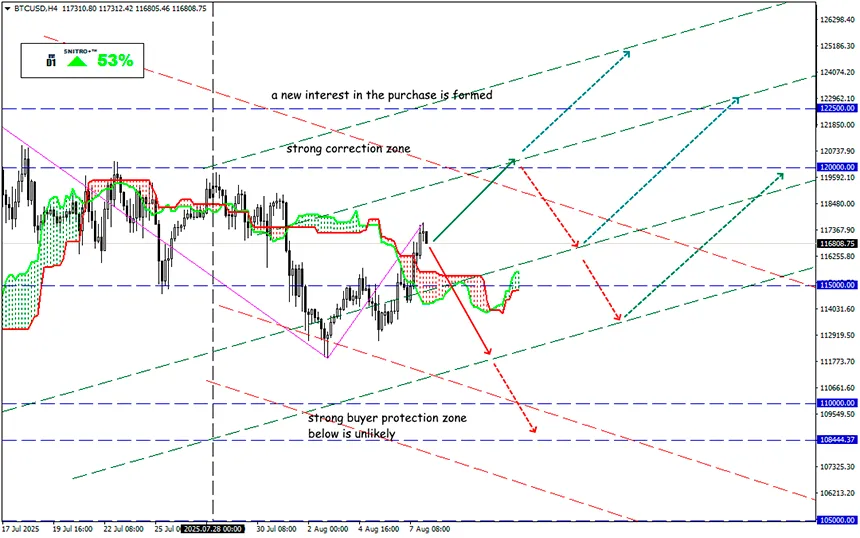

#BTCUSD

Key zone: 116,300 - 117,500

Buy: 117,500 (on a breakdown after a correction); target 120,000-121,300; StopLoss 116,800

Sell: 116,000 (on strong negative fundamentals) ; target 113,500; StopLoss 116,800

The US president has signed an order that will change the way long-term wealth is built for millions of Americans.

For the first time, the $9 trillion US retirement market is open to cryptocurrencies, direct investments, and other alternative assets within 401(k) retirement plans. The world’s largest economy is effectively stating that cryptocurrencies and other alternative assets are not just private speculators or hedge fund managers, but a legitimate part of global financial capital.

The demand for such investments has existed for a long time. People want to control their future and use new capital-building technologies. Now, this can be done directly in their retirement portfolios under the guidance of financial professionals and with the protection of sensible regulation.

Trump’s order instructs regulators to modernize the system that had restricted access to such fast-growing opportunities as bitcoin in retirement accounts. Until now, over 90 million American workers saving for retirement through 401(k) plans had been locked in a narrow world of stocks and bonds.

The document also sets new professional requirements for investors and advisers. Crypto markets behave differently from traditional stocks or fixed-income securities. Crypto means extremely high volatility and risk, and only investors with strict diversification and control strategies can earn in the long term.

This is a huge source of liquidity, but one must be realistic — pension funds will not buy crypto at speculative prices. Moreover, Trump’s order limits the amount of funds for crypto investments. In reality, pension fund capital has long been in the crypto market through spot ETFs, which can be freely purchased, so nothing fundamentally changes for such investments.

Should we expect an active bull market for crypto?

Most likely yes, but for now only in the medium term. The regulatory mechanisms for implementing the law are still being developed, and there are many hidden obstacles along the way.Moreover, against the backdrop of global optimism, it will be necessary to consider factors related to specific tokens, such as the conclusion of the SEC-Ripple trial.

But for now, buying with reasonable risk is possible.

So we act wisely and avoid unnecessary risks.

Profits to y’all!