Politicians take a break: markets keep working rhythm

So …

- Eurozone

EU leaders held a video summit to discuss the situation with the pandemic. New strains of coronavirus amid a shortage of vaccines have led to a discussion about the need to close external and internal borders, but so far they have only agreed to tighten quarantine measures. Today the European Commission will propose new measures for internal controls and compulsory testing.

In Rome, Premier Conte needs to find the support of a majority in the Senate to maintain power. No one in Italy wants early elections, but the mainstream parties see no other way out if the prime minister does not win a majority.

So far, according to polls, Salvini's Eurosceptic party «Liga» is leading, which strikes fear in investors. The denouement should be this week. Base case: formation of a technical government, but when early elections are called, the euro should fall sharply.

- Great Britain

The pound continues to be in demand on the back of good vaccination rates and easing fears of negative BOE rates. However, UK PMI for January is negative, the appearance of additional facts of an economic slowdown in other reports will lead to an increase in expectations for easing the BOE policy and the sale of the pound will continue.

Britain sparked the first major EU scandal since Brexit by refusing to grant full diplomatic status to the EU ambassador in London and his 25-member mission. The problem has been heating up for over a year but has now escalated from the leaked letters, which show that EU Foreign Minister Josep Borrell is seriously concerned about the status granted to EU officials in the UK.

as recent polls show most voters in Scotland and Northern Ireland are hoping for another secession attempt. Scotland's First Minister Nicola Sturgeon has said she will take advantage of the Scottish parliamentary elections in May 2021 to drum up voter support for a new referendum on the region's independence.

- FRS, January 27

This year's first meeting of the regulator should not worry traders. No monetary policy adjustments are expected, and there will be no new economic forecasts. Market should react to Powell's rhetoric, but the big speculators are not interested in the situation. Jay has to assess the economic situation: since the December meeting, two failed key reports have been released − on the labour market and retail sales.

But if Powell intends to open a season of additional optimism, then the moment is right.

If Jay concentrates on the negative, then the stock market could fall short-term along with the dollar. Powell can choose neutrality with a description of the positive and negative aspects of the situation, which will be favourable for the growth of the dollar.

Fed will continue its tactic of denial about the possibility of reducing the size of the QE program in the foreseeable future. But if the current size of the QE program is again announced until the end of the year, the dollar will fall. If there are hints of a reduction in QE volume, the dollar will rise.

In general, what matters is not what Powell says now, but the change in his rhetoric after Yellen was appointed Treasury. This topic needs to be monitored, because if Powell's behaviour and rhetoric change dramatically without significant prerequisites for this, then Yellen's influence is great and to understand the Fed's policy, you will have to wait not for the Fed's meetings, but Janet's speech.

And some news from the world of oil:

- Invoices examined by Bloomberg prove that China continues to smuggle raw materials from Venezuela regardless of the US embargo. In addition to transhipment between tankers, dummy companies and jamming satellite signals, there is now a slight change in the chemical composition and grade of raw materials in the documents. For example, oil loaded in Venezuela, for example, Hamaca, is mixed with chemical additives off the coast of Singapore and supplied to the market under a new name, for example, Singma or simply bitumen mixture.

- Iran announced an increase in oil production and is ready to double volumes within a few months. This will be a strong negative for oil, but so far prices are quite stable, since for export growth Iran needs to get rid of US sanctions, and this process could be delayed.

- Biden's decision to cancel the Keystone XL pipeline project has caused a strong wave of negativity. The line is supposed to transport more than 800,000 barrels of oil a day from the oil sands of Alberta south to the US Gulf Coast and beyond to overseas markets. Business officials say Canada should be prepared to use «meaningful» punitive measures against its largest trading partner. There is no official reaction from the Trudeau administration yet.

Basic statistics of the current week:

- USA − GDP for the 4th quarter, consumer spending inflation, consumer sentiment survey according to the SV and Michigan, weekly jobless claims;

- Eurozone − GDP of Germany, Spain and France for Q4, German IFO index, consumer price inflation in Germany and Spain for January, German labour market report.

- UK − Labor Market Report.

Xi Jinping and Merkel are expected to speak at the Davos Agenda 2021 online event of the World Economic Forum today.

The FRS continues a «period of silence», there is no timetable for important speeches yet.

Christine Lagarde will speak at an online discussion on green banking. IMF Managing Director Georgieva to Speak at Online Summit on Adaptation to Climate Change.

Tomorrow, Saudi Arabia will host the Future Investment Initiative Forum, dubbed Davos in the Desert. The International Monetary Fund is to publish updated forecasts for the development of the world economy.

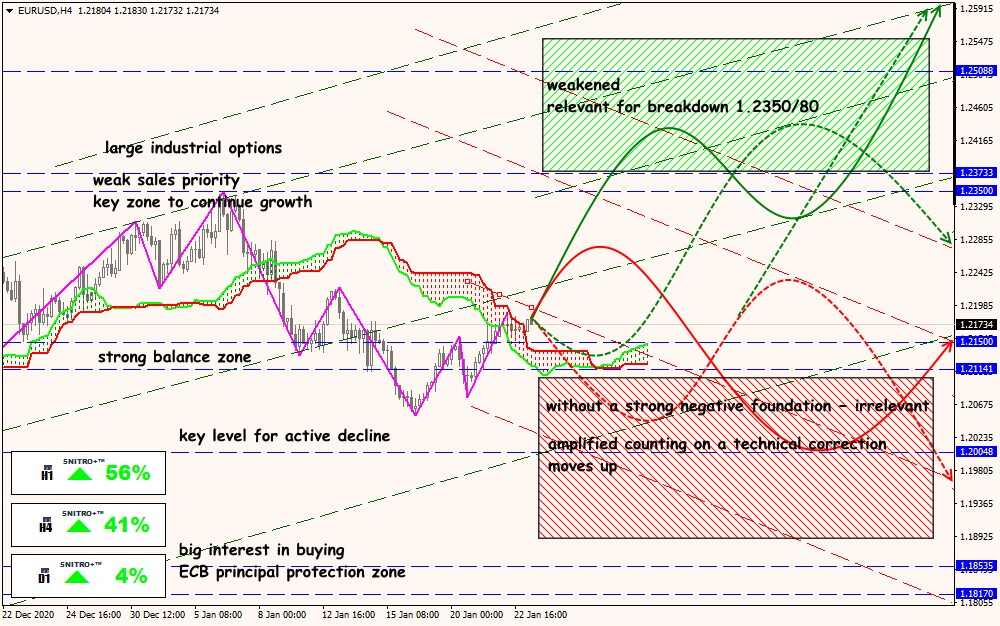

Technical Analysis of EUR/USD

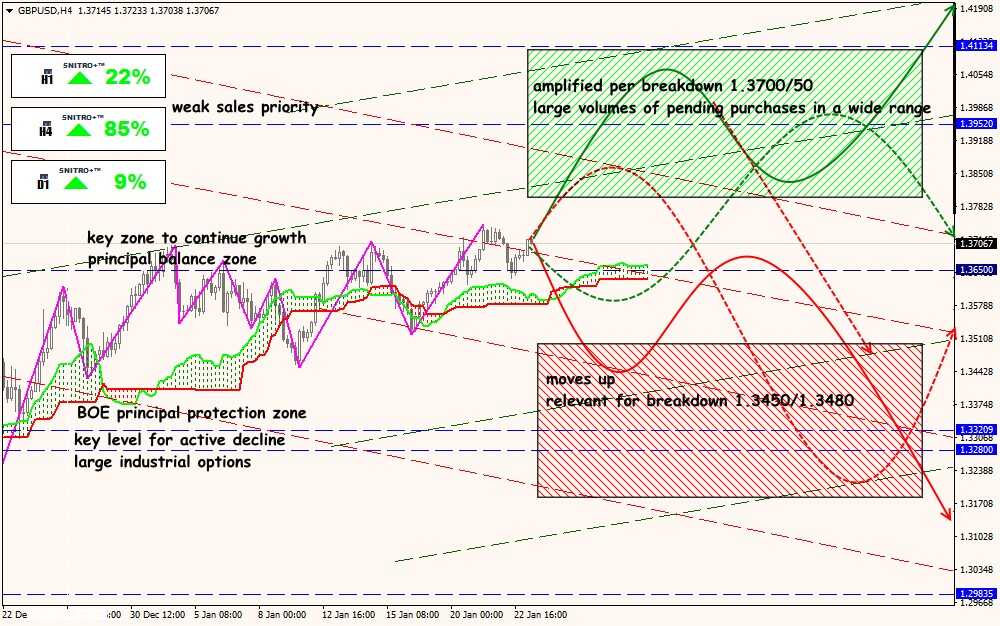

Technical Analysis of GBP/USD

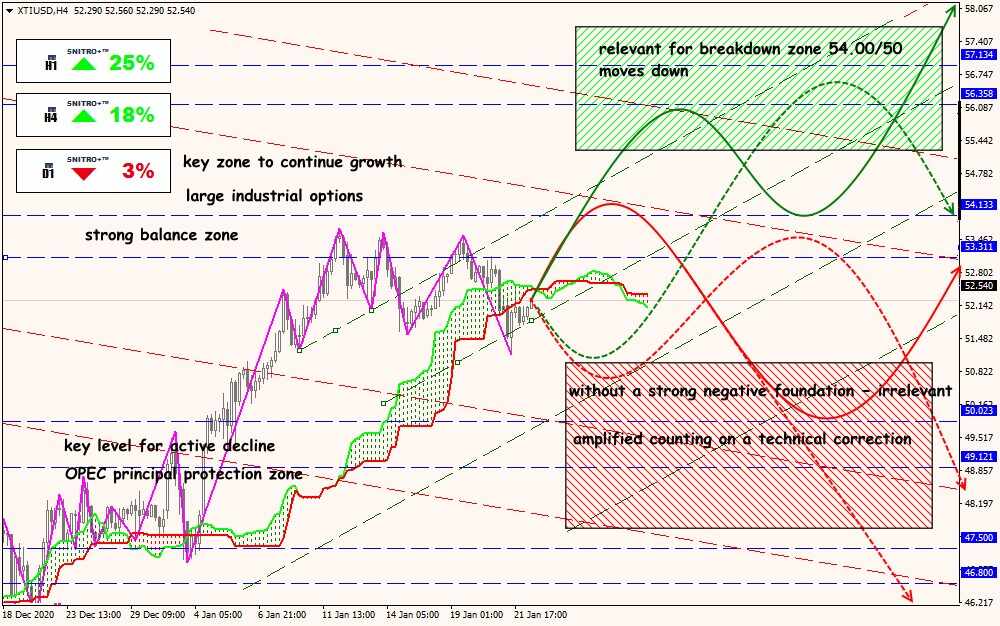

Technical Analysis of XTI/USD