«Bluff instead of America»: Show closed. What's next?

Trump tried to play all-in with a minimum of trump cards but immediately lost. Crowd, instigated by president, went to storm the shrine of American democracy, completely shutting off their brains and not realizing consequences of their actions. Those who hooligans in the Capitol on January 6 are now being dealt with by the FBI, and Donnie is facing charges of preparing and attempting a coup d'état. Democrats push to remove Trump from office. Another attempt at impeachment is unlikely, although Democrats will try to take away Trump's opportunity to run for president in 2024.

Congress, together with the Senate, approved the election results. All factors of political influence are now under Biden's control: there is a real majority in the House of Representatives, and parity in the Senate can be easily broken by Kamala Harris. Even in Georgia, both new senators are Democrats: a pastor and a filmmaker have replaced big businessmen. But if Joe Biden (suddenly!) Turns out to be not at all such a «cool grandfather» as he is now being estimated, and the Democrats allow the strengthening of the radical left of Bernie Sanders, then it will take a long time to wait for a real result in the economy.

Investors have largely ignored the Capitol scandal. The political chaos failed to stop the rally in the US stock markets, although the backlash from world leaders was quick and active. By the way, Germany has strengthened the protection of the Bundestag. In general, the markets clearly do not intend to hang in politics − there are more urgent tasks.

- Nonfarm Payrolls

The December NFP was perceived by analysts as a failure, although expectations were also negative. The unchanged levels of unemployment U3 and labor force participation can be considered positive, with a negative number of new jobs, which, of course, was influenced by the revision for the two previous months: There is no strong impact on the markets, but the official estimate of the Fed, which has not been announced yet ... Powell's opinion needs to be traced.

- FRS

From the text of the latest protocol, it follows that the Fed began to discuss the withdrawal from the QE program, which is a warning to the markets, since the bubble in the stock market is out of touch with reality and is supported only by an injection of liquidity. The volume of asset purchases remains ($120 billion monthly). Once collective immunity is achieved from the coronavirus, the Fed will have to start rolling back its ultra-soft policy, which will be a negative surprise for risky assets. Due to the intentions of the Democrats to increase the compensation check too quickly from $600 to $2000, there is a risk of higher inflation and an increase in the rate of the US debt market. If such a scenario comes true, then you will have to think about raising the rate.

From other news, we note:

- Another impetus to the growth of quotations was provoked by the fact that Saudi Arabia unexpectedly decided to reduce its production of raw materials by 1 million barrels per day for the next two months. OPEC + non-OPEC made a compromise decision, which can be considered the beginning of the weakening of the alliance of the OPEC cartel with its situational partners. OPEC countries will keep oil production unchanged in February and March, the Russian Federation and Kazakhstan intend to increase production by 65,000 and 10,000 barrels, respectively.

- The Saudis are raising prices for consumers in Asia and the US, but Saudi oil will be cheaper in February in northwest Europe and the Mediterranean region. Incidentally, last week the Saudis did not supply a single barrel of oil to the United States for the first time in 35 years.

- Bitcoin is up 40% YTD and is first recorded in the $41000 zone, but JPMorgan Chase & Co. confident that this growth is only 25-30% of potential traffic. Due to the negative pandemic, bitcoin is actively «crowding out» gold as a reserve «alternative» asset. Now, to match total private sector investment in gold, the digital currency's market capitalization needs to grow 4.6 times, which is (theoretically!) Equivalent to $146000.

- The G7 and BRICS countries will face the largest bond redemption in the last 10 years this year − about $13 trillion, this amount was created by last year's record-breaking borrowings. The volume of refinancing exceeds the last year's figure by 51%. The largest account is $7.7 trillion. will receive the US government, Japan will have to refinance $2.9 trillion, and China − $577 billion. In Europe, the leaders remain Italy − $433 billion, France − $348 billion and Germany − $325 billion. The positive is that the world's central banks and investors are on the side of the borrowers. Regulators, forced to deal with the effects of the pandemic, will continue to follow the stimulating course and keep interest rates low. Also, bonds remain a good defensive asset, which is readily bought.

Please note this week:

- USA − retail sales, consumer price inflation, weekly jobless claims, consumer sentiment research; job vacancies JOLTs, Fed Beige Book;

- Eurozone − no serious economic reports, only the Sentix investor confidence index is of interest.

- UK − the release of statistical data on GDP on Friday. The spread of a new strain of coronavirus restrains the growth of the pound, market participants fear that the economic decline due to strict quarantine measures will provoke BOE to further cut rates.

- China − inflation report, CPI and trade balance.

On Friday, fans of commodity assets should not miss the monthly OPEC report on the oil market.

The Fed chief will appear in front of the public on Thursday. It is supposed to have a conversation in the form of a dialogue, so the probability of the announcement of new monetary stimulus from the Fed is very small. Jay has finally achieved minimal proficiency in maintaining risk appetite in markets without specific promises, which makes the dollar more likely to decline during his speech.

Lagarde is speaking today, but a significant market reaction to her rhetoric is unlikely. On Wednesday, the head of ECB will discuss the European economy in an online conference.

ECB Minutes, published on Thursday, are interesting because of the disagreement among ECB members over the duration and use of the full size of QE PEPP program.

Biden intends to present a plan for economic recovery on Thursday. According to him, the fiscal stimulus will amount to «trillions» of dollars, including expanded unemployment benefits, direct payments ($2000), and an infrastructure project. Listening and analyzing is a must.

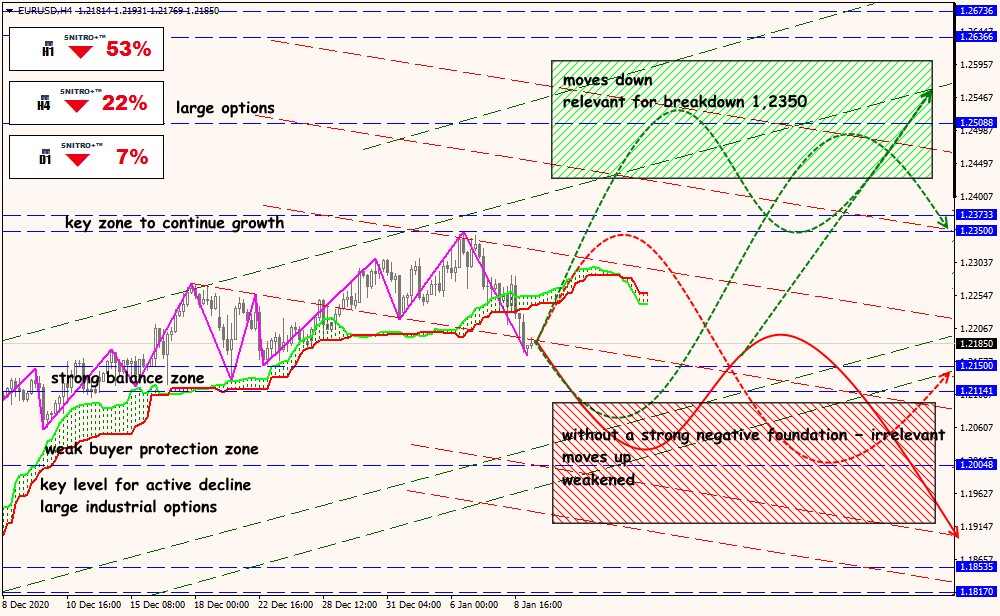

Technical Analysis of EUR/USD

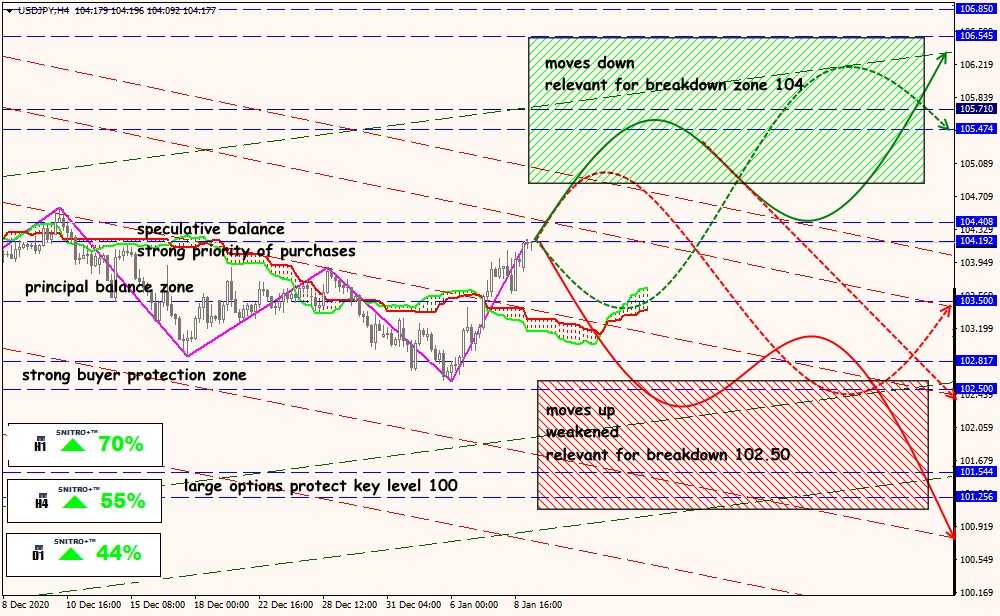

Technical Analysis of USD/JPY

Technical Analysis of XTI/USD