Predators, hunters and victims: market wars become more active

Though large investors prefer not to risk without an understanding of results of elections to European Parliament, status with Brexit and the decision of the ECB, the focus of the market does not change and the very active week is expected to us.

- Elections…

… to European Parliament will take place from 23 May to 26 May, Britain will vote on 23rd, all large EU countries will vote on 26th, the result will become known Sunday evening and the markets will open with a gap. Euro politicians of a various rank received an incentive to loud statements, for example, the Deputy Prime Minister of Italy Salvini is sure that he is ready «to change this Europe», and, in particular, to violate fiscal rules of the EU to increase jobs and to reduce twice unemployment rate in Italy (to 5%). Salvini heads the movement of eurosceptics, together with Marine Le Pen and Nigel Faraj so far.

All key posts, including the EU President and the head of the ECB depend on elections to European Parliament, the EU summit devoted to consultations on the distribution of positions will take place on 28 May. The euro coalition acquires the right to appoint the candidate for a post of the head of European Commission, from euro optimists such candidate is German Manfred Weber, the head of European People's Party, from eurosceptics Salvini applies for this post. Nevertheless, serious surprises are not expected, it is quite probable that after elections to European Parliament the stand of the Italian politicians will considerably be softened.

- Brexit …

May was succeeded to postpone setting a date of the resignation during the meeting with the head of the executive committee of the Tory. If the parliament, after all, ratifies the agreement during the week since 3 June, then Theresa should work the first act of Brexit with necessary updating of the legislation, but if the agreement is failed again, then May will resign immediately after the vote. Anyway, the outcome will come next week, and the technical ascending correction, at least, to the 26th figure is required for GBP/USD before this.

- Тariffs …

Trump postpones the introduction of tariffs for euro cars against the background of negotiations on trade with the EU and Japan. Unexpectedly for himself, Donald has faced wide opposition concerning duties from the automotive industry and legislators: suppliers categorically do not agree with the assumption that imported components represent a risk for national security. But risks of a drop in employment in the automotive industry and number of the accompanying sectors of the economy of the USA on 366 thousand jobs – are quite real. The current week the first round of trade negotiations between the USA and EU is planned, results will be analyzed at a meeting of ministers of trade of EU countries on 27 May.

- China …

The Asian markets are concerned by a gain of the anti-American rhetoric in the Chinese media against the background of escalation of the trade conflicts. Information from China for April appeared failure, but Beijing strengthens trade defense to hope that the White House will change the owners already next fall. The threat of large-scale sale of the American papers is strongly exaggerated – it will cause chaos in unstable Chinese business, and dollar depreciation will help Trump to reduce the trade deficit with China. Dollars for the American bonds China will invest in other assets − euro, pounds, yuans, and partially offsets the losses. And if China stops buying agricultural goods and energy carriers in the USA, will reduce orders for Boeing and will close for itself the sector of the American services, then the medium-term negative will be more essential to the USA. At some point the dollar will become so cheap that import from China will be equal in the price to export, the trade deficit will disappear and Trump will calm down. But for the American consumer this process together with an increase in rates will be painful, but China will be assigned guilty.

The situation is aggravated by access lock on the markets of the USA of products of Huawei and other Chinese companies. In Huawei consider that the American restrictions will lead the country to stay outside 5G, and announced aspiration more actively to develop the relations with the EU and the countries of Asia. Colleagues from Europe do not support Trump yet and do not prohibit products of Huawei in the markets so the reaction to a failure of trade negotiations in the form of growth of euro is temporary.

The negative from already existing and future rates against China begins to press on the world economy and the more surprises so very reserved reaction of the markets to the events. The current agreement between the USA-China is scuttled, and resuscitation is improbable. The meeting of the top officials on a G20 summit is planned, but the plan of additional 25% duties on the Chinese goods of $300 billion announced which will become effective approximately during the meeting of Si and Trump. If de facto the parties cancel the mutual dialog, then perspectives of trade negotiations very gloomy.

- For this week …

The protocol of the last meeting of FRS is hopelessly outdated at the moment, the train of thought of members of FRS at the time of the meeting is of interest, and it is improbable that the publication on 22 May will be able to lead to the considerable reaction of the market.

The main statistics to the current week: regarding the USA − durables, reports on the sector of the real estate, PMI of the industry and services, regarding the Eurozone − PMI of the industry and services of EU countries and the IFO index of Germany.

The pound rigidly depends on Brexit, but surely it is worth tracing the inflationary report and data on retails. We monitor China – if NBC devaluates yuan exchange rate to a dollar above mark 7.0 it is necessary to expect a gain of escape from risk.

It is worth paying attention to Powell's performance in 24.00CET Tuesday because Jay is able to please the markets with unexpected changes in the opinion. Draghi will act twice the forthcoming week, but probably both actions will be closed for media. We wait for the insider after the intermediate meeting of the ECB on Wednesday, on Thursday it is necessary to pay attention to the protocol of the ECB, especially with respect to a subject of discussion of multilayer system of deposit rates.

Technical Analysis EUR/USD

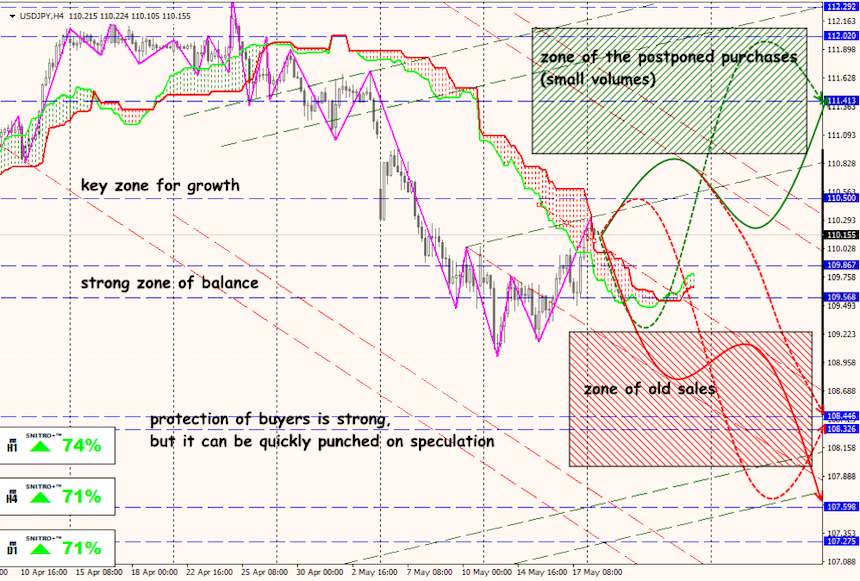

Technical Analysis USD/JPY