Bulls Power indicator

The basic principle of market: those who want to buy cheaper, are constantly fighting with those who intend to sell more expensive.

- Mathematics and parameters

- Trade indicator signals

- Strategy with use of the indicator

- Several practical notes

The basic principle of market: those who want to buy cheaper, are constantly fighting with those who intend to sell more expensive. The technical Bulls Power indicator assesses the chances of market to increase. It is used to support positions in a growing market and to analyze the current balance of bulls/bears.

Mathematics and parameters

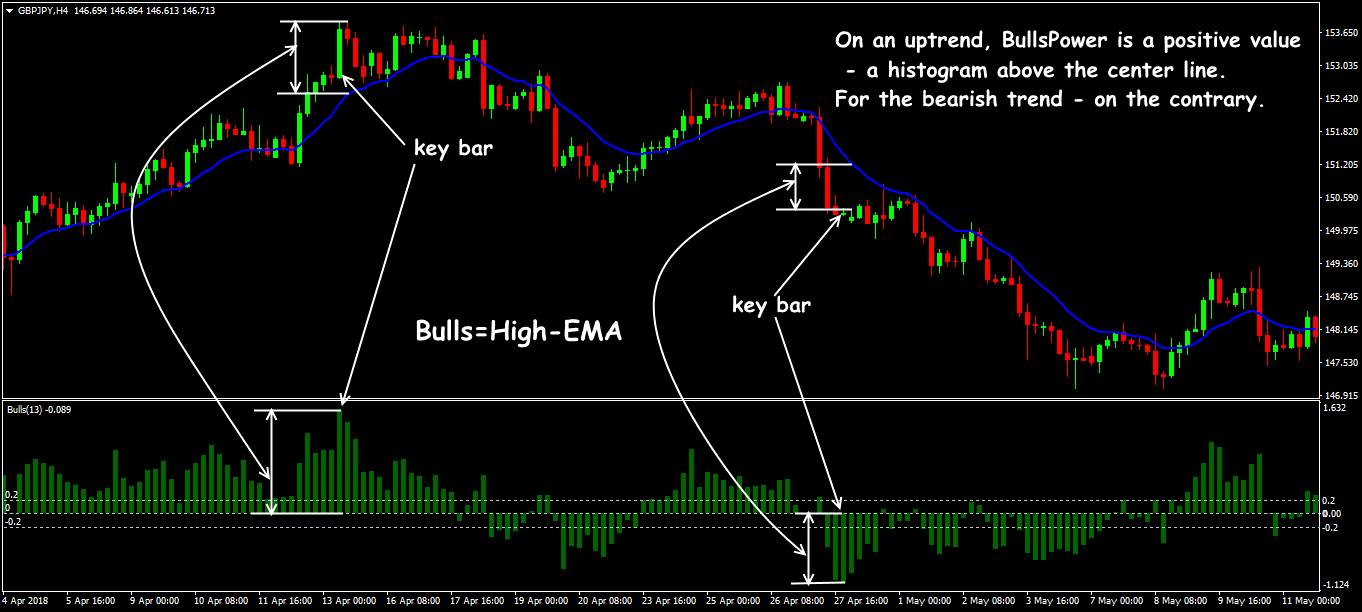

The task of indicator is to assess the pressure of sellers on the ability of buyers to raise price even higher. In order to take the most recent data into account, Bulls Power calculates the exponential moving average, line of which shows the balance of interests, and the value of indicator estimates the maximum price, that is, at the current moment active buyers (bulls) have shifted balance to their side.

For each bar, Bulls Power indicator is calculated as the difference between the maximum price and value EMA(13).

The higher the bar's maximum from the base moving average, the greater value of Bulls Power indicator (longer the «positive» bar of histogram) and the stronger interest in purchases.

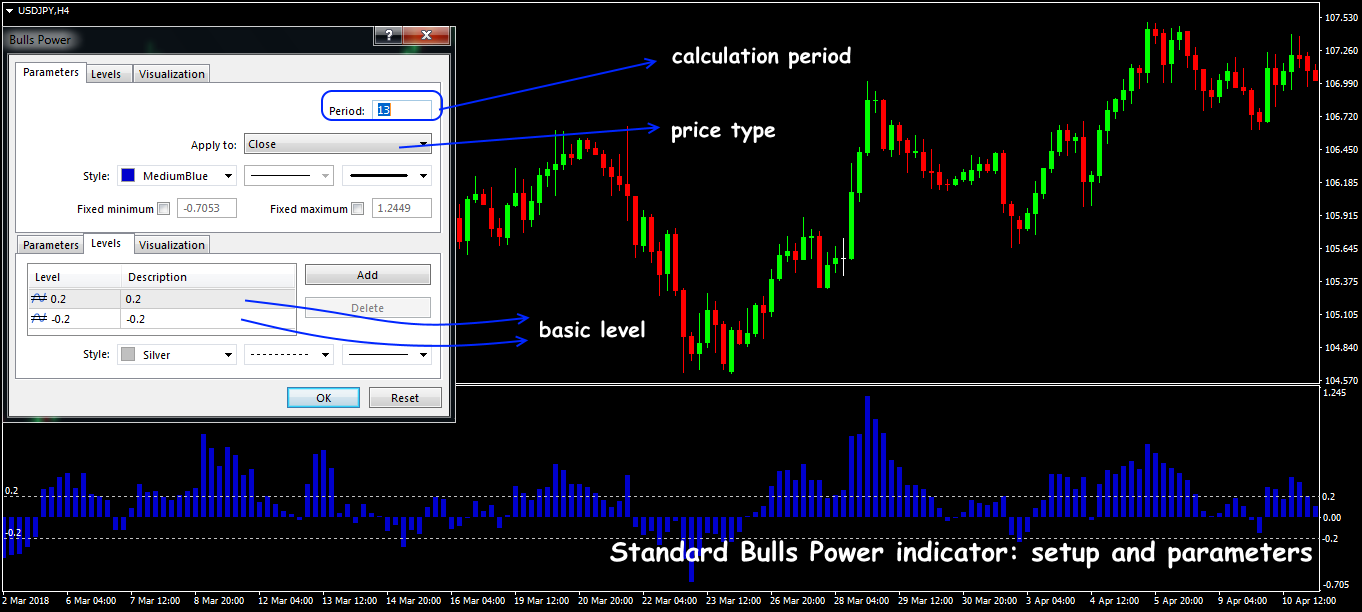

Today indicator, developed in 1989 as an element of the famous Elder Rays system, is included in the standard set of indicators for most trading platforms, only one parameter − the number of bars for calculating relative dynamics. It is a single-color histogram with a dynamic zero line; traditional colors − blue or green.

Bulls Power indicator allows you to visually assess the market balance of purchases/sales: the dynamics above central line − a bullish trend; bars above zero line is a downtrend.

Trade indicator signals

To calculate Bulls Power, Alex Edler anticipated the following:

- basic moving average is an agreement on a «fair» price between buyers and sellers for a certain period;

- the high price is a reflection of the maximum strength of customers during the trading period.

Consider situations that can be analyzed using Bulls Power.

If the market is dominated by bulls, then the Ask price increases, which from the point of view of market theory means:

- or there is a customer in the market who bought the asset at a previous (lower) market price, and waits for it to rise (holds a buy or increases interest to purchase);

- or in the market there was a seller who does not agree to such a low price and cancels his deal (reduces the volume of transactions for sale).

Any of these events leads to an intensification of the bullish trend.

Standard interpretation of trading situations Bulls Power indicator:

- strong uptrend − the histogram is located above balance line and at the same time shows a tendency to increase;

- if the histogram is above zero level, but the beams are directed downwards (the tendency to decrease), then we can assume that, despite the still bullish sentiments on the market, their strength is weakening;

- when the histogram passes through he zero level from top down − «bulls» lost control of the market and bears increase pressure; waiting for price to turn down − confirm the situation may Bears Power indicator;

- the growth of histogram, which is below zero, suggests that while sellers dominate the market, their strength begins to weaken and buyers gradually increase their interest;

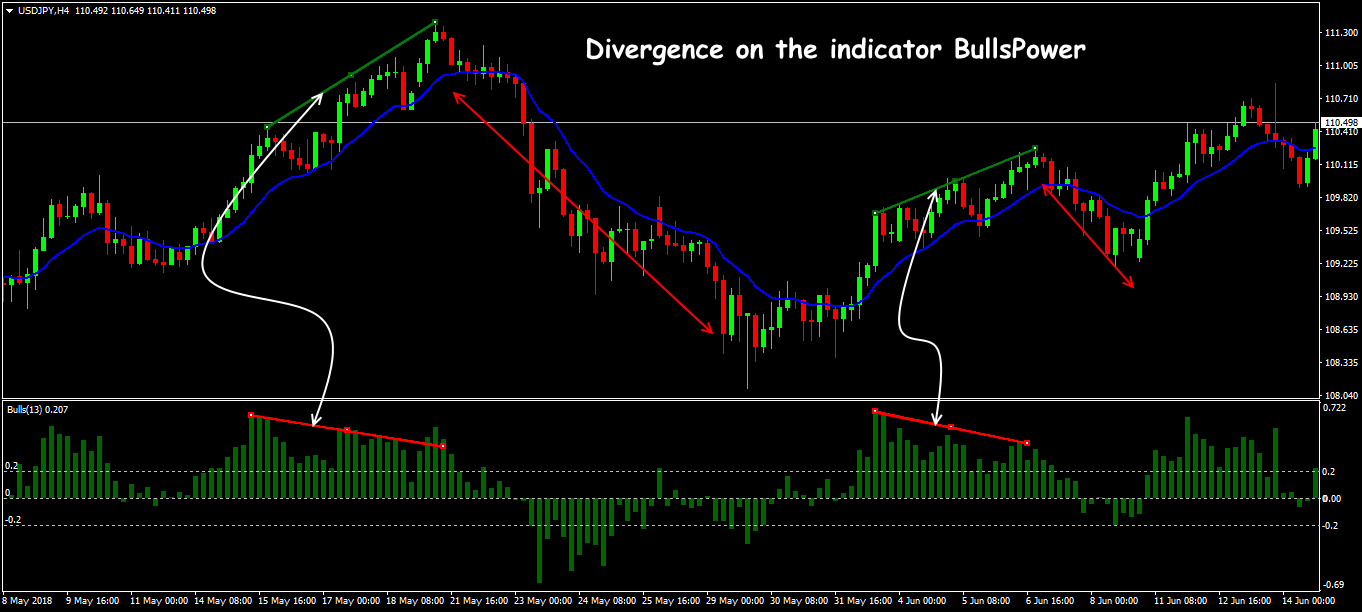

- divergence situations between the price schedule and Bulls Power histogram − a traditionally strong reversal signal.

Strategy with use of the indicator

The ability at any time to correctly determine the dominant direction allows any trader to open positions along with major players in the market. However, you can use Bulls Power indicator only with trend instruments such as BollingerBans, Parabolic SAR, moving average sets.

The use of this oscillator makes sense only for an abstract assessment of trend, and its result should be used only to confirm the main signals. We draw your attention that in periods of unstable market (speculation on news, force majeure, opening/closing of trading sessions), the Bulls Power histogram behaves «traditionally», that is, incorrectly. The analysis period is at least H1, at small timeframes the histogram shows a lot of false signals, so scalpers are not recommended for this indicator.

Several practical notes

The objective interest of buyers with the help of Bulls Power indicator is extremely difficult to estimate, if only because there are no real trading volumes in Forex terminal and the volume is not taken into account in the process of analysis. You can not make a trade decision on the price dynamics, although using the Bulls Power indicator significantly increases the chance to close the deal on time.

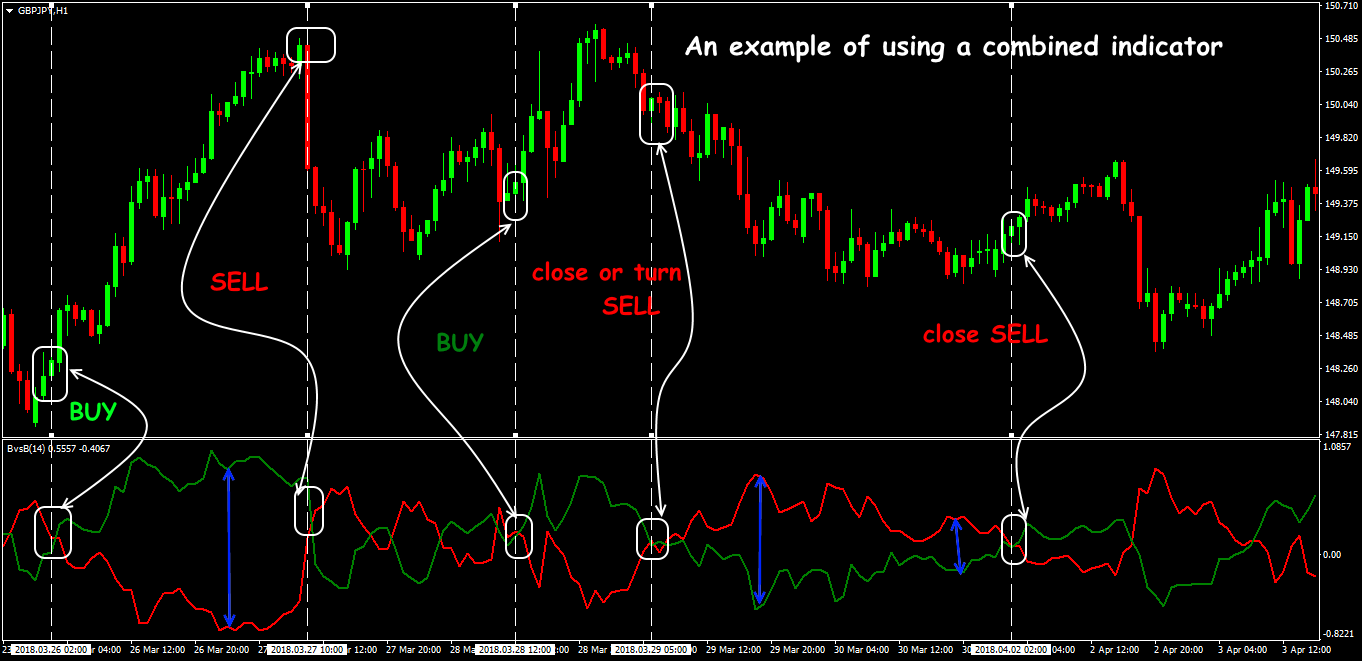

You can recommend the use of combined versions, such as Bulls-Bears-Balance or BvsB, which visually show the current balance of bulls/bears and the stronger side of market.

Of the positive moments, it is also worth noting a simple calculation and an unambiguous technique for interpreting signals. Bulls Power indicator is not sensitive to the type of trading asset (currencies, stock and commodity market) and is perfectly combined with any technical analysis tools.