Zigzag indicator

Forex ZigZag indicator is intended for the analysis of price movements with a given amplitude and represents the trend sections, the main turning points and other moments of trend changes.

Contents

- Mathematics and trade logic

- Installation and settings

- How to use Zigzag indicator in Forex

- Several practical remarks

This greatly facilitates the visual analysis of the price chart.

Mathematics and trade logic

The indicator ZigZag filters the market noise by the usual comparison method, allocates price extremes in the data array and performs a minimum of graphical constructions. If the price dynamics satisfies the calculation parameters − the price chart is plotted with key points, which are then connected by straight lines.

For example, the indicator formula first «looks for» a price minimum corresponding to the conditions of the Depth parameter (see below), and fixes it on the graph. Further, if the market continues to fall, each time the price will be reduced to a distance of pitch (Deviation setting) or more, ZigZag indicator will «move» trend line of lower and lower.

When the market performs a turn (in this example − the price starts to increase), ZigZag Forex indicator visually fixes the current minimum and completes the construction of a separate section of its broken line. After that, the calculation mechanism starts to search for a new local maximum. The analysis period (in bars) is determined by the Depth parameters. If the price continues to rise, the indicator line will move up. The local maximum will be updated until the conditions for reverse reversal appear on the market, and then the cycle repeats.

Installation and settings

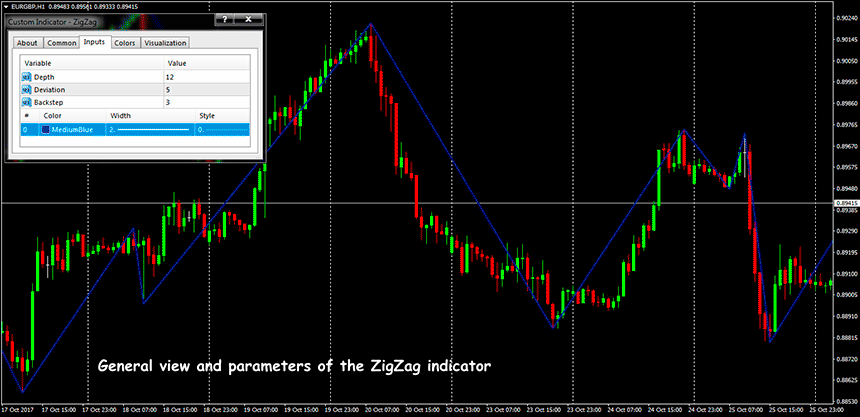

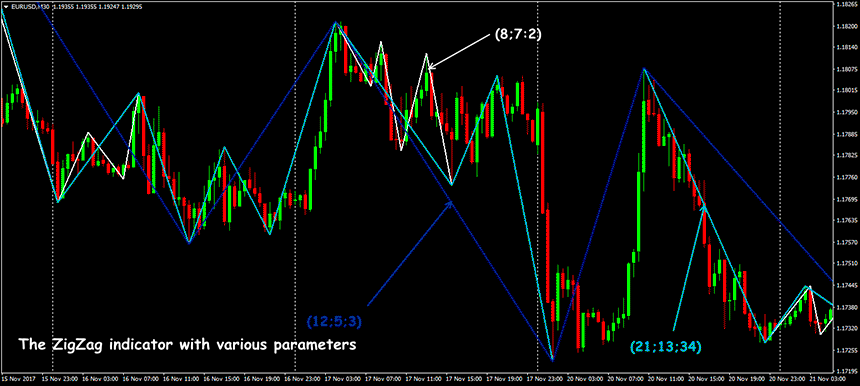

The standard version of the Forex Zigzag indicator is offered in all popular trading terminals, there are no special requirements for installation. The composition and names of the parameters in different versions of the indicator may differ, but in the settings there are always three basic values. They determine the conditions of the filter, which will distinguish between significant and insignificant price fluctuations, that is, which extremes the calculation mechanism will consider significant and, accordingly, connect these sections with trend lines.

So:

- Deviation is the minimum value of the number of points in% between min and max of two adjacent bars, which will be sufficient to form a local vertex or local cavity. The default value is 5% (values greater than 10% are not recommended, at least for Forex). This means that all price movements ≥ 5% will be marked by the ZigZag line, and smaller fluctuations are ignored;

- Depth − the minimum number of candles at which ZigZag does not build the next max / min, even if the conditions of the first parameter are met;

- Backstep − the minimum number of candles between adjacent local max and min. In practice, you can experiment with key parameters, for example, for trading assets with unstable or too high volatility. But do not forget that changing the base values affects the degree of sensitivity of the indicator to the movement of prices.

If the calculation parameters are too small, the number of local minima and maxima will increase, the ZigZag indicator Forex will build more small sections and make the long-term trend line more «torn». Increasing the basic parameters will cause the indicator to ignore small fluctuations and will pay attention only to global sections of the trend − in this case, it is more likely to miss profitable entry points to the market.

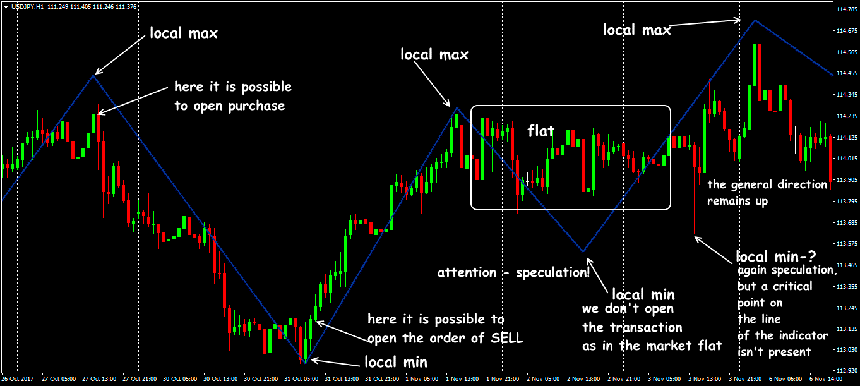

How to use Zigzag indicator in Forex

The main purpose of trading with ZigZag indicator is to analyze the availability and quality of the trend, as well as price reversals. As a result, the trader is not distracted by intermediate price fluctuations within the trading period.

Also using the indicator, you can search (and test) support/resistance levels: horizontal price levels are determined at key points of the indicator line. If you determine the direction of the trend in a classic way − through the tops and bottoms, then the indicator greatly simplifies the formation of trend lines: they can be built on the main extremes of ZigZag, as a result we get a fairly accurate price channel.

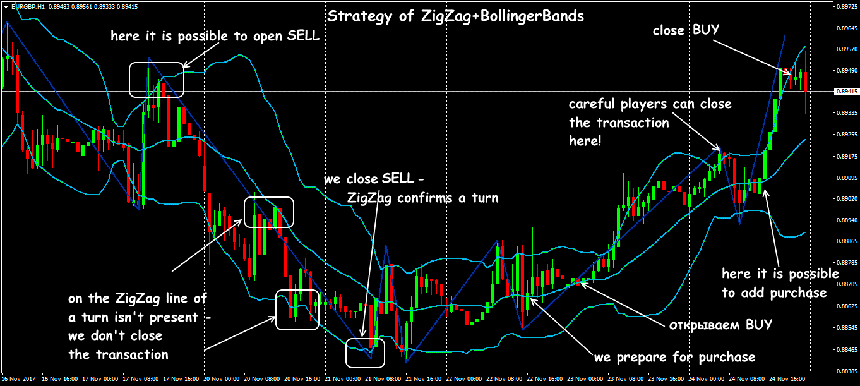

However, you cannot accept a trading solution only on the ZigZag indicator information − it can only be used in conjunction with other tools.

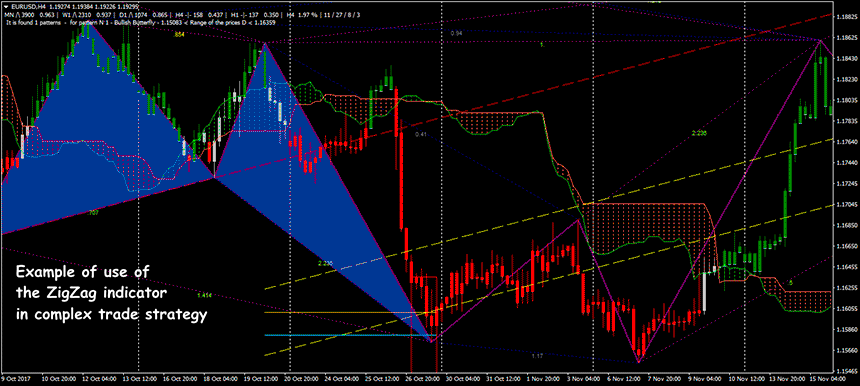

The ZigZag indicator is most effective in combination with other technical analysis tools − oscillators, fractals, price channel indicators or Elliott wave structure. For example, the key points of the ZigZag line perfectly confirm the price behavior in the BollingerBand boundary zone.

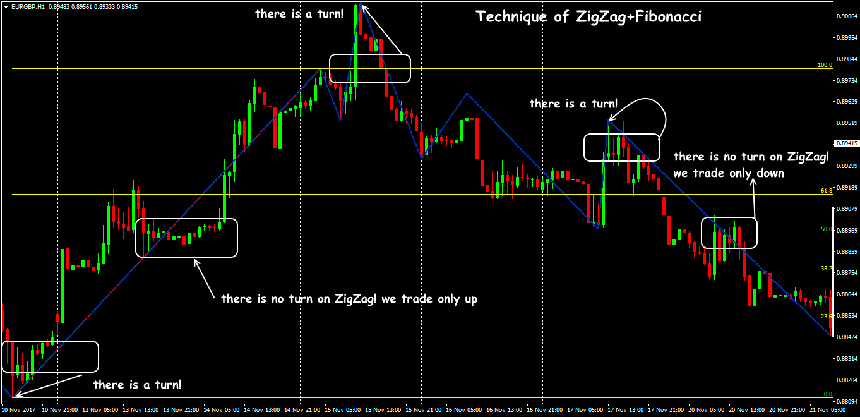

A reliable set is obtained with Fibonacci levels: it can be used for determination of the end of rollback in a trend, as a rule, it occurs at the levels of 38.2, 50% or 61.8%. Key points on the line of the ZigZag indicator can be used for the StopLoss installation, and for additional confirmation of point of entry it is possible to use any oscillator.

Accurate lines of the indicator help to define wave structures and graphic patterns, for example, such as Gartli's butterfly. It is recommended to use ZigZag Forex indicator on the periods from H1 above.

Several practical remarks

How to use ZigZag indicator to open trade transactions? The main thing − is not to forget that the last (uncompleted) segment is always in dynamics: the position of the end point is constantly changing, until the mechanism for calculating the indicator «decides» that a new extremum has formed.

If you change the calculation period, the overall graphic picture is redrawn, but on each separate timeframe, the indicator lines built earlier are saved.

The indicator only works with actual data (in the price history), does not give obvious trading signals and does not make any forecasts. But at the same time, it thoroughly filters market noise, visually shows the priority trend and graphic patterns, allows opening/closing transactions in time − and thereby saves the trader from losses.

On any trading asset, this indicator works with the same accuracy, but do not forget − its calculation does not use smoothing or averaging mechanisms. As a result, any inadequate price shots cause an incorrect reaction on the ZigZag line, therefore the indicator information cannot be trusted during speculative market periods. Nevertheless, Zigzag Forex indicator is a sufficiently effective tool for assessing the current market position − we recommend that everyone include it in your trading arsenal.