Bears Power indicator

In the financial market price movement provides two types of exchange players: «bulls» are trying to raise the price, «bears» are trying to maximally reduce it.

- Mathematics and parameters

- Trade indicator signals

- Strategy with use of the indicator

- Several practical notes

The popular technical Bears Power indicator estimates the interest in the sale and the chances of the market to reduce prices. It is used to support positions in the downstream market and as an indicator of the current bear/bull equilibrium.

Mathematics and parameters

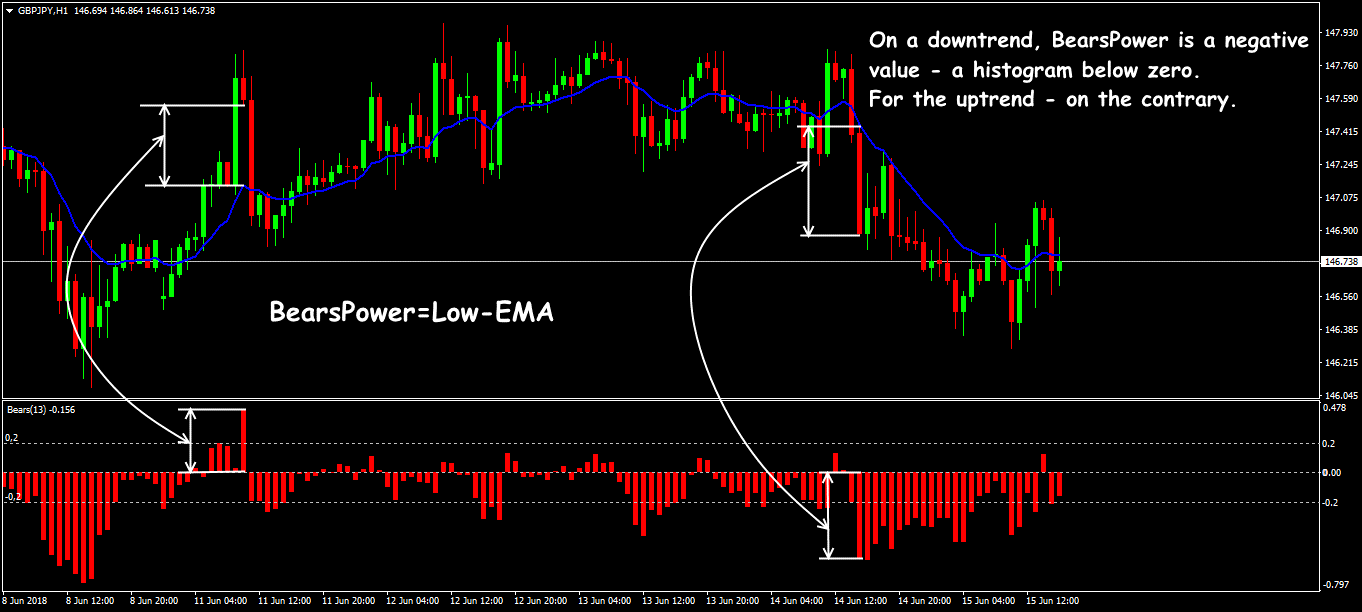

The indicator is based on a simple idea: if the price decreases, then profit must be obtained from transactions for sale. Bears Power is calculated on the basis of exponential moving average and estimates the minimum current price, that is, how active sellers (bears) have dragged the market to their side. The indicator developer worked with a 13-period exponential mean − from its value the current minimum price of the bar is simply subtracted.

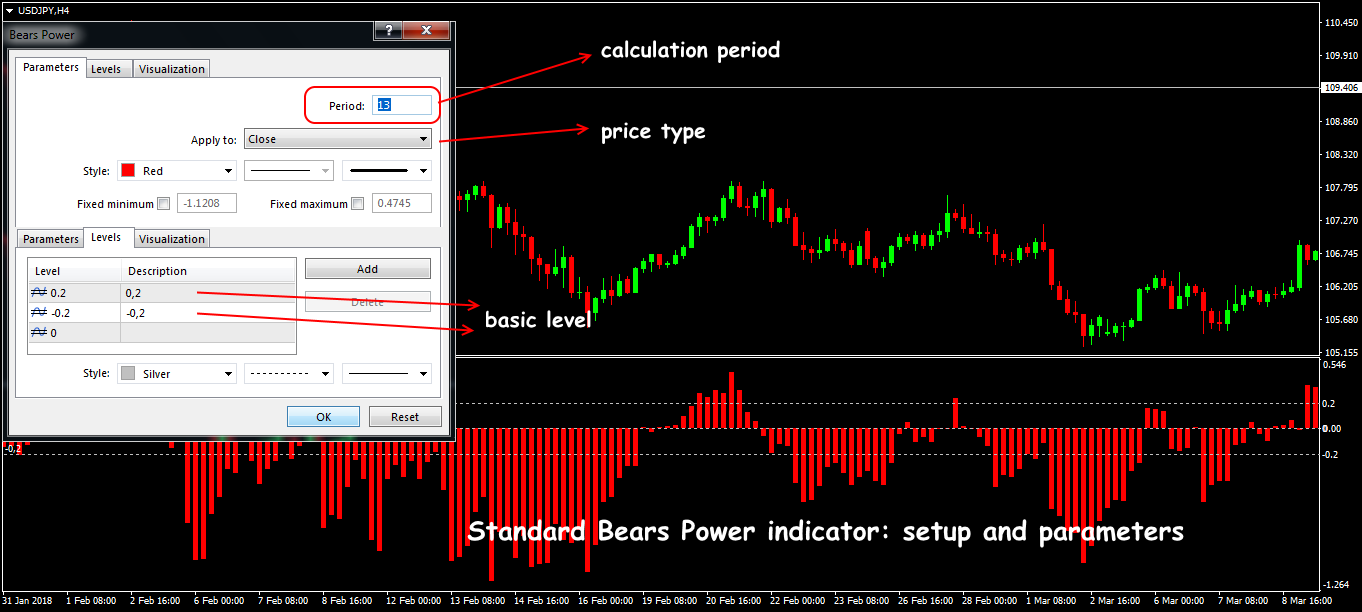

The lower the minimum of the moving average line, the greater value of Bears Power (the longer «negative» bar of the histogram) and the stronger interest in sales. Usually Bears Power indicator is offered in the standard set of indicators for all popular trading platforms, parameter one − the number of bars for calculating relative dynamics. It is a single-color histogram with a dynamic zero line. The traditional color is red.

The indicator provides an opportunity to visually assess the ratio of purchases and sales: the dynamics below zero line − a downtrend; bars above zero line is an upward trend.

Trade indicator signals

To calculate Bears Power indicator, Alex Edler proceeded from the following prerequisites:

- moving average is the price agreement between bulls and bears for a certain period;

- minimum price is a reflection of the maximum strength of sellers during trading day.

Let's talk about situations that can be analyzed with the help of Bears Power. If bears predominate in the market, then the Bid price decreases and, from the market point of view, this means that in the market:

- or a customer appeared who sold the asset at a previous (higher) market price, and waits for its further reduction (holds sell or increase the volume of transactions for sale);

- or there is a buyer who is not ready to buy a low price for this price, and therefore cancels his offer (reduces interest in buying).

Any of these events leads to an increase in bearish sentiment.

The main interpretations of trading situations Bears Power indicator:

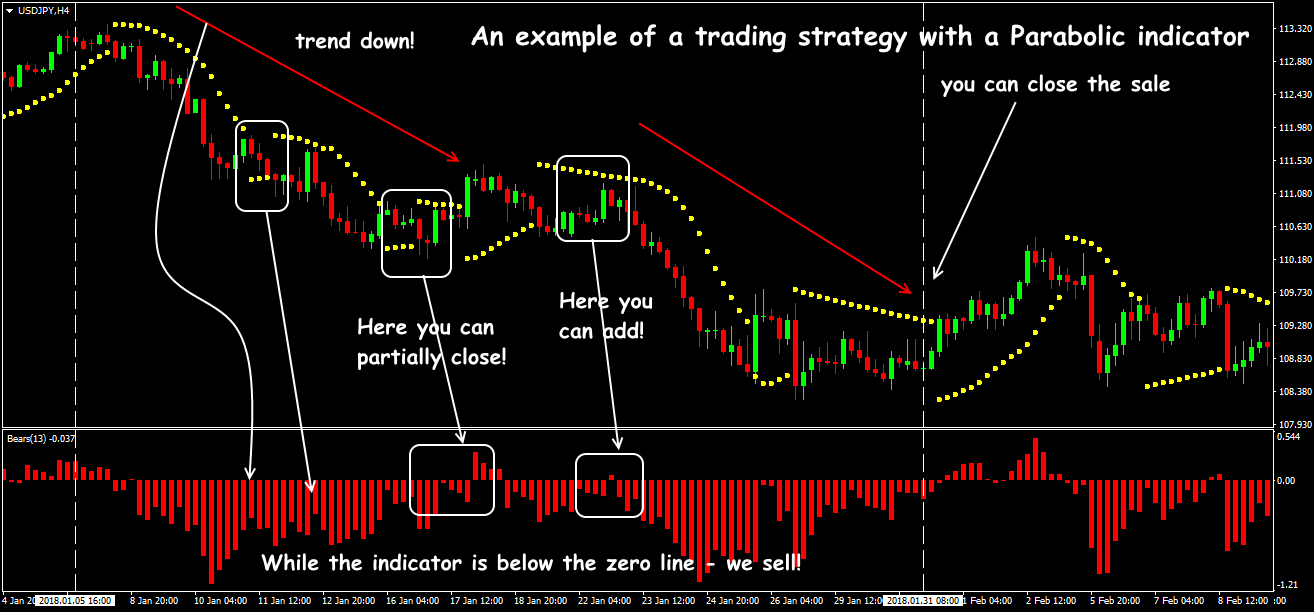

- strong bearish trend − the histogram is located below the central line and at the same time shows a tendency to fall;

- if histogram is below zero level, but with the rays pointing upwards (upward trend), then we can assume that, in spite of still bearish sentiment in the market, their strength begins to weaken;

- when histogram passes through zero level from bottom up − «bears» have lost control over the market and bulls increase pressure; waiting for price to go up − Bulls Power indicator can confirm the situation;

- fall of histogram, which is above zero, indicates that while the bulls prevail on the market, their strength begins to weaken and the bears gradually increase their pressure;

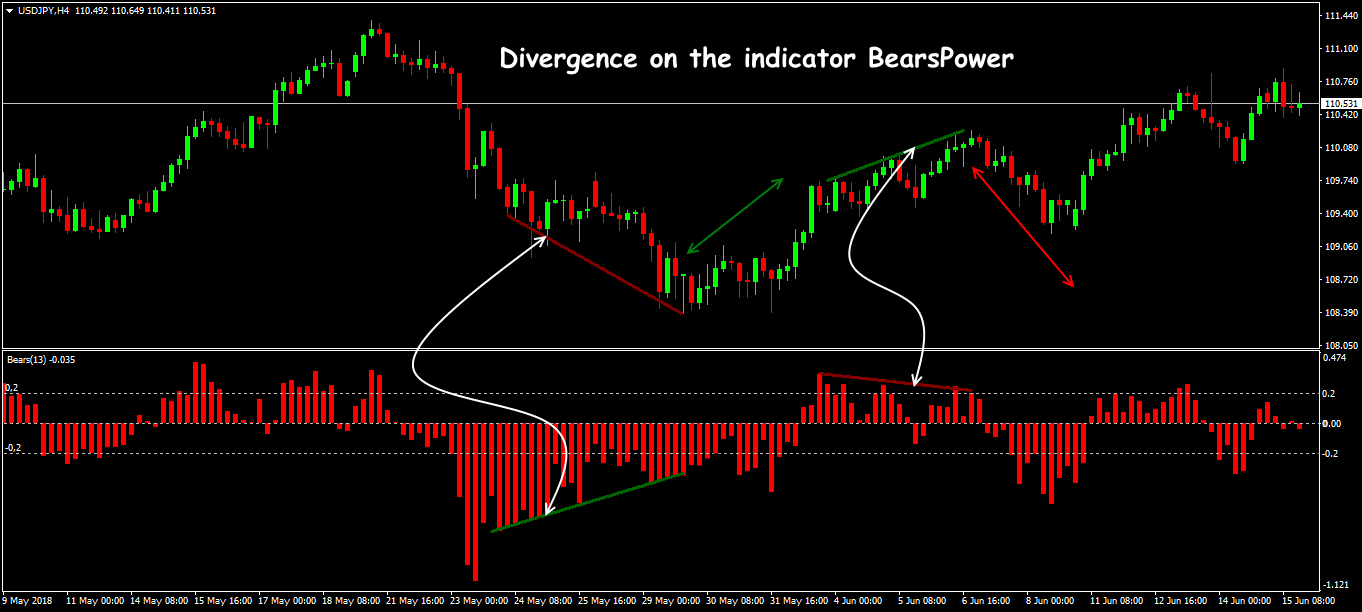

- divergence situations between the price schedule and Bears Power histogram − the strongest reversal signal.

Strategy with use of the indicator

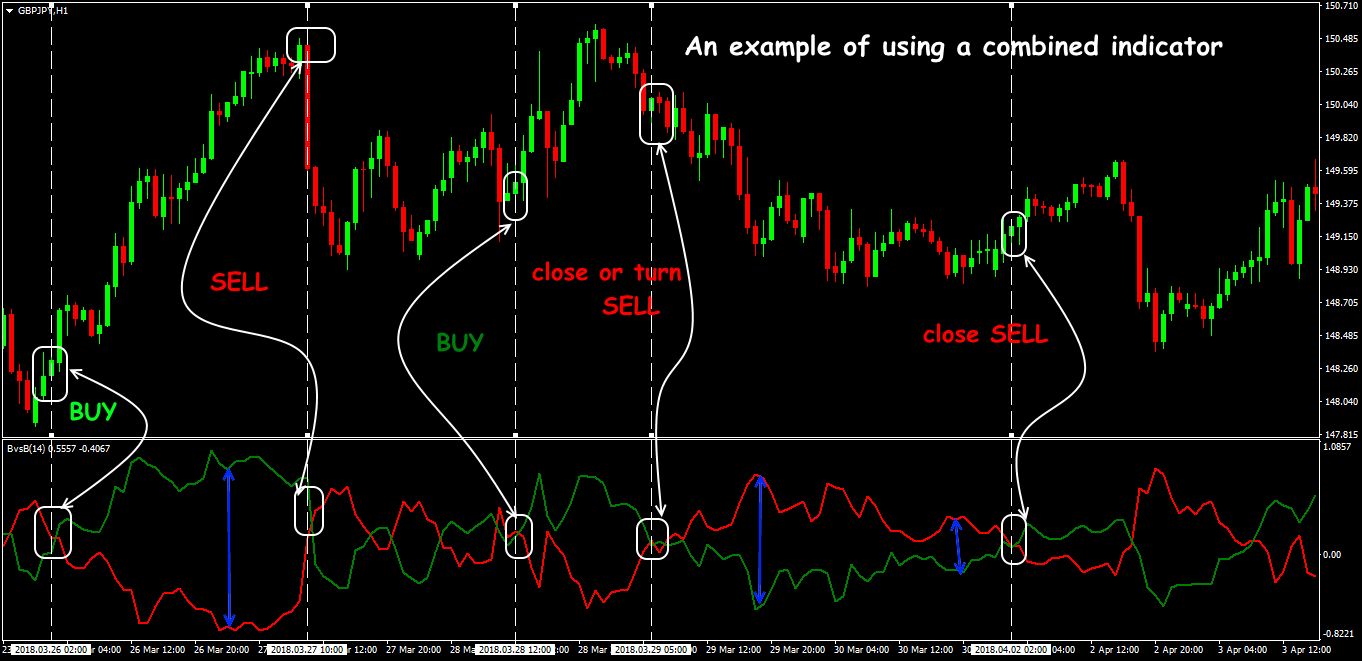

A correct understanding of who dominates the market at moment allows traders to enter this leading group. Nevertheless, Bears Power indicator makes sense to use only in conjunction with any trend indicator, for example, moving average variants, Parabolic SAR, Bollinger Bans. Elementary calculation and a simple visual form of the graph allows you to unambiguously interpret trading signals.

Pay attention: on the speculative price movement (news, force majeure, opening/closing of trading sessions), Bears Power histogram behaves like any oscillator, that is, it is incorrect. The trading sense is analyzed on timeframes not lower than H1, so this indicator is not recommended for scalping.

Several practical notes

The real interest in sale is estimated by Bears Power indicator quite approximately, especially since there are no real trading volumes in the Forex terminal. Evaluation of the strength of sellers only in terms of price dynamics can not be used to make a trading decision.

The use of this indicator is effective only in the abstract analysis of market - to assess the continuation of current trend, and its "opinion" should be taken into account only for qualitative confirmation of the main signals. Using the dynamics of Bears Power indicator , you increase your chance to open/close the transaction at the optimum moment.

More effective is the use of options for combined indicators, such as Bulls-Bears-Balance, which assess the mutual relation bears/bulls and show the prevailing at the moment players.