Acceleration Deceleration

Acceleration Deceleration Oscillator: indicator of force of the players' pressure on market

Contents

- Mathematics and parameters

- Trade indicator signals

- Strategy with use of the indicator

- Several practical notes

Acceleration Deceleration indicator is designed to assess the driving force of market − the third factor in Bill Williams' «Trading Chaos» system; it is considered a logical continuation of indicator Awesome Oscillator and the most sensitive element of strategy.

The leading indicator Accelerator Decelerator realizes in practice the idea that before the change of direction the price changes in last turn. Before a turn, the price should reduce the speed of movement in the current direction, and therefore, you need to have data on the acceleration of the price (positive or negative). When the dynamics of the first slowdown, the histogram of indicator should turn around, and when the current dynamics accelerate, show growth. At the time of the actual turn, the acceleration of the price should be zero.

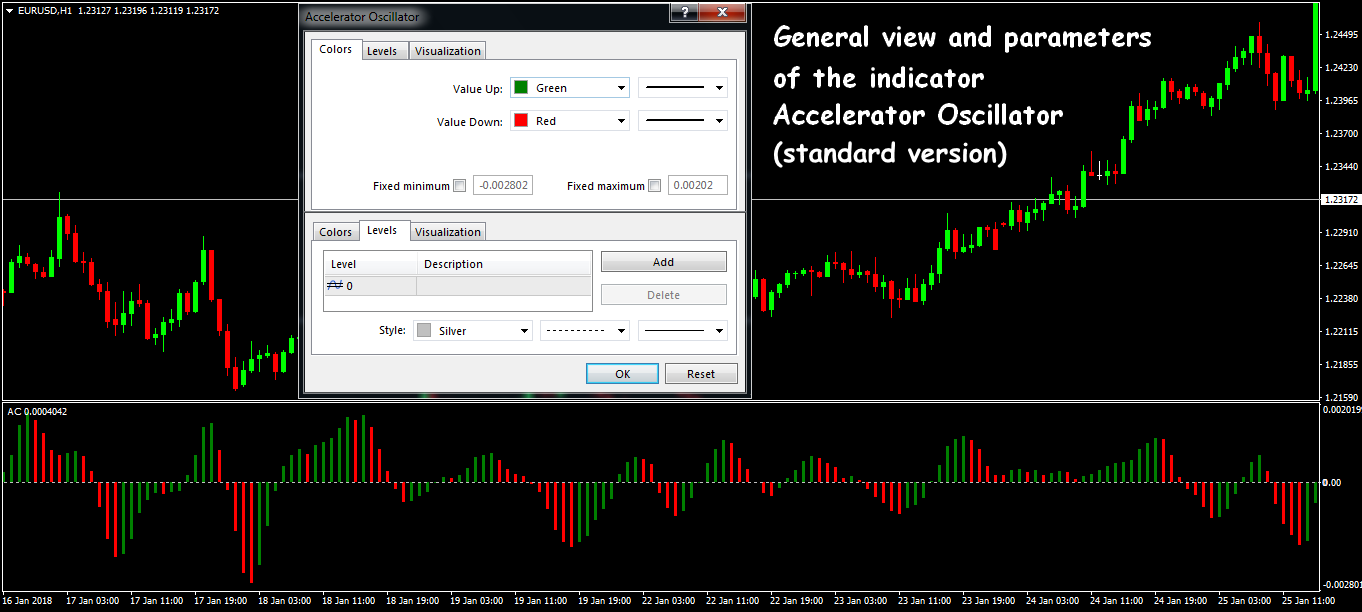

Mathematics and parameters

Accelerator Oscilator histogram is the difference between histogram and SMA(5) values from Awesome Oscillator. That is, we consistently calculate:

- median price: MedianPrice = (high+low)/2;

- values AO = SMA(MedianPrice, 5) − SMA(MedianPrice, 34);

- values AC = AO − SMA(AO, 5).

In some sources, the concept of a typical price (typical price) is used for calculation − average calculation also includes the closing price: (High+Low+Close); it is assumed that such a price moves more smoothly than the usual average.

The zero line of indicator means zone where the driving force (according to Williams' theory) is equal to the current acceleration; this baseline is dynamically shifted depending on the values of indicator.

Acceleration Deceleration Oscillator is included in all popular trading platforms and is displayed as a colored histogram in an additional window. Green bars of histogram are periods of price growth, red bars are periods of decline. There are non-standard variants of the indicator with placement of the histogram right on price chart.

Trade indicator signals

Accelerator Decelerator is always ahead of the actual dynamics, that is:

if the histogram is above the zero line (+) and at same time:

- grows − bullish trend intensifies (buyers are stronger, price is easier to go up);

- decreases − bullish trend weakens, a reversal or a flat is possible;

if the histogram is below the zero line (-) and simultaneously:

- falls − bearish trend «accelerates» (sellers prevail, price is easier to decline);

- increases − descending direction weakens, we wait for a turn or a flat.

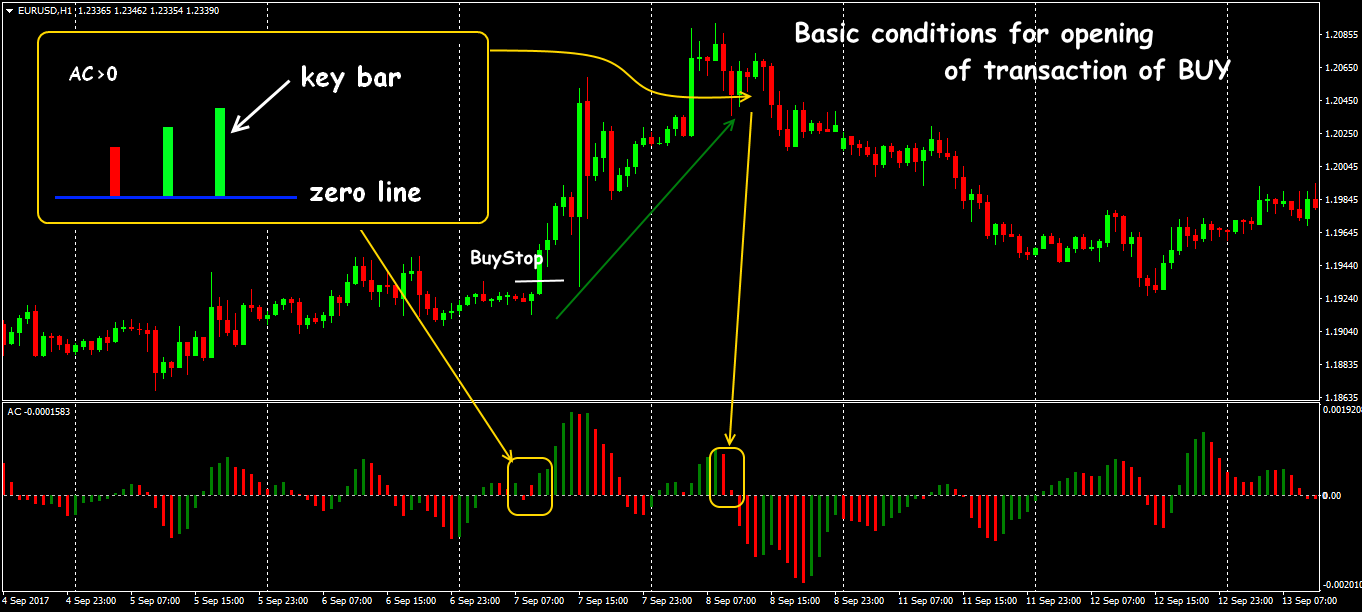

If you open a deal in the direction of strengthening the driving force (on the positive histogram − buying, on the negative − selling), then two bars of the corresponding color are enough.

Purchase signal (Acceleration indicator):

A positive histogram should form 1 red and 2 green consecutive bars with higher highs (the general direction changes from bottom to top). BuyStop order is placed 1-5 points above max of the signal bar.

Sale signal (Deceleration oscillator):

A negative histogram forms consecutively 1 green and 2 red bars with lower minima (the direction changes from top to bottom). SellStop order is placed 1-5 points below min of the signal bar.

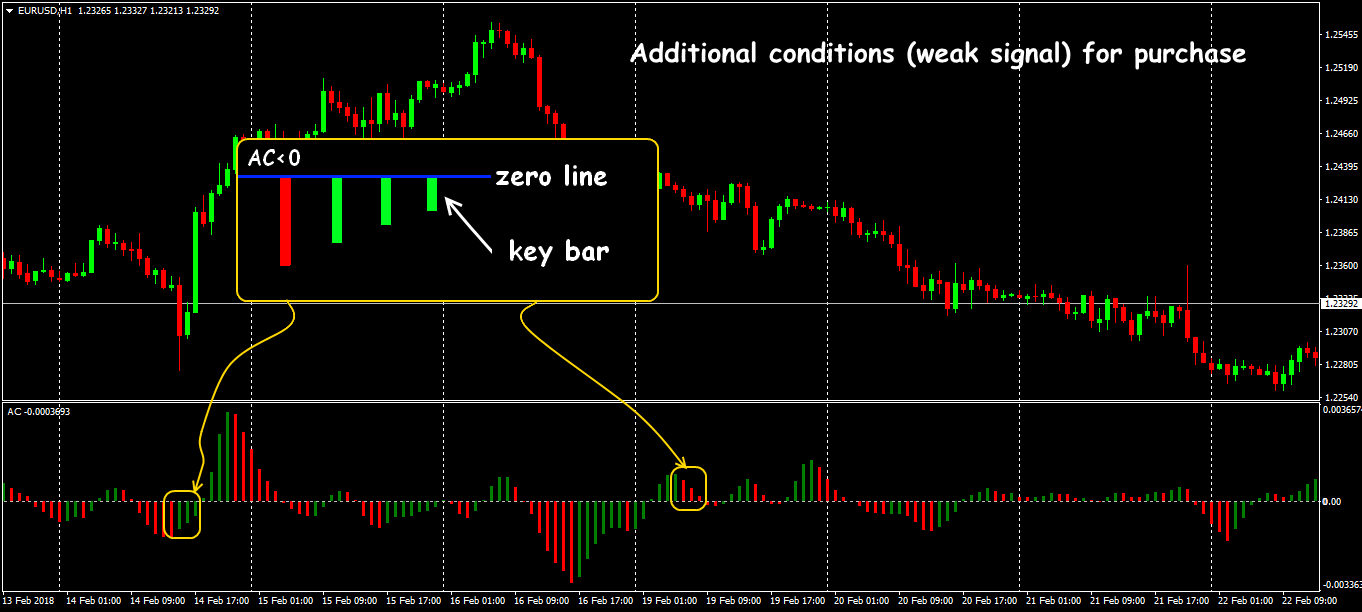

If you open a trade against the direction of acceleration (buying a histogram below or selling on a histogram above the zero line), then an additional bar is required as a confirmation signal.

In this case:

Signal for purchase:

A negative histogram should form 1 red and 3 green consecutive bars with higher lows. Order BuyStop put on 1-5 points higher than the price of a High signal bar.

In this scheme: if one of the first 2 green bars breaks the balance line, then you can buy already on the third bar.

Signal for sale:

It is enough to appear on the positive histogram 1 green and two red bars, which are consistently reduced. SellStop order is placed 1-5 points lower than the price of the price of a Low signal bar.

If one of the first two bars crosses the balance line, you can open SELL already on last red column.

Crossing the zero line with the histogram Accelerator Decelerator is not a trading signal! The fact of breakdown of the balance line affects only the required number of bars to identify the trading signal.

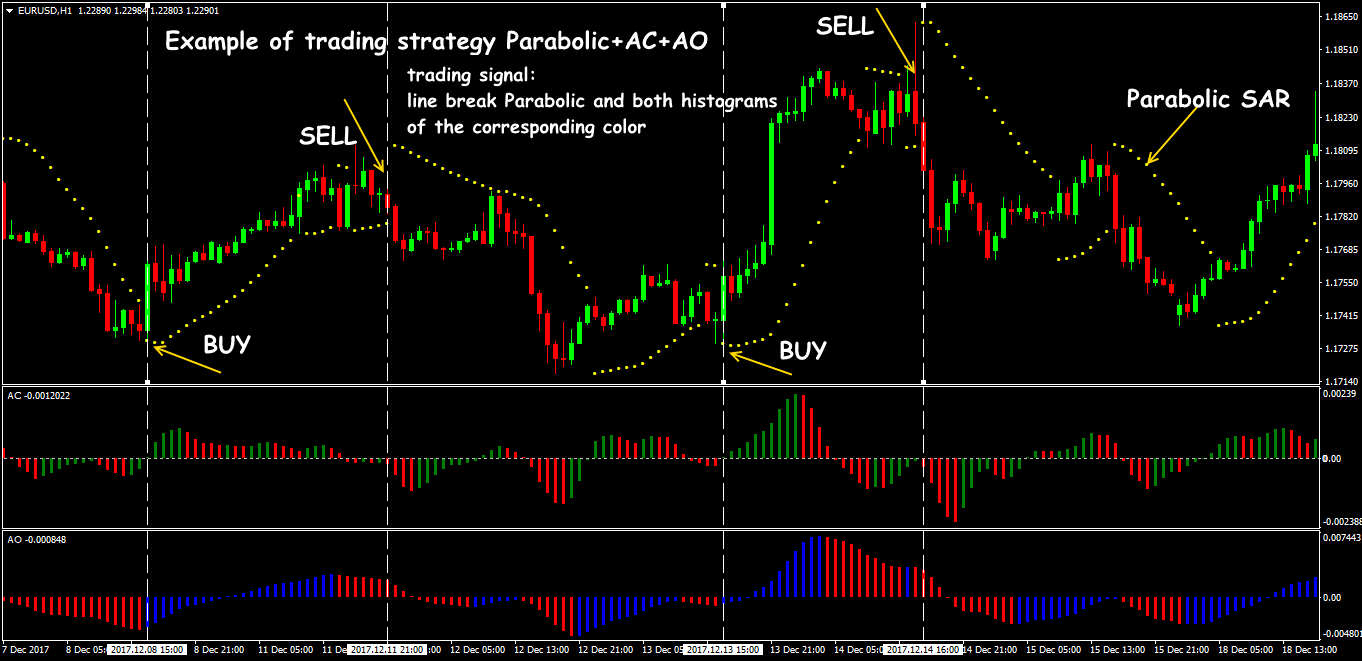

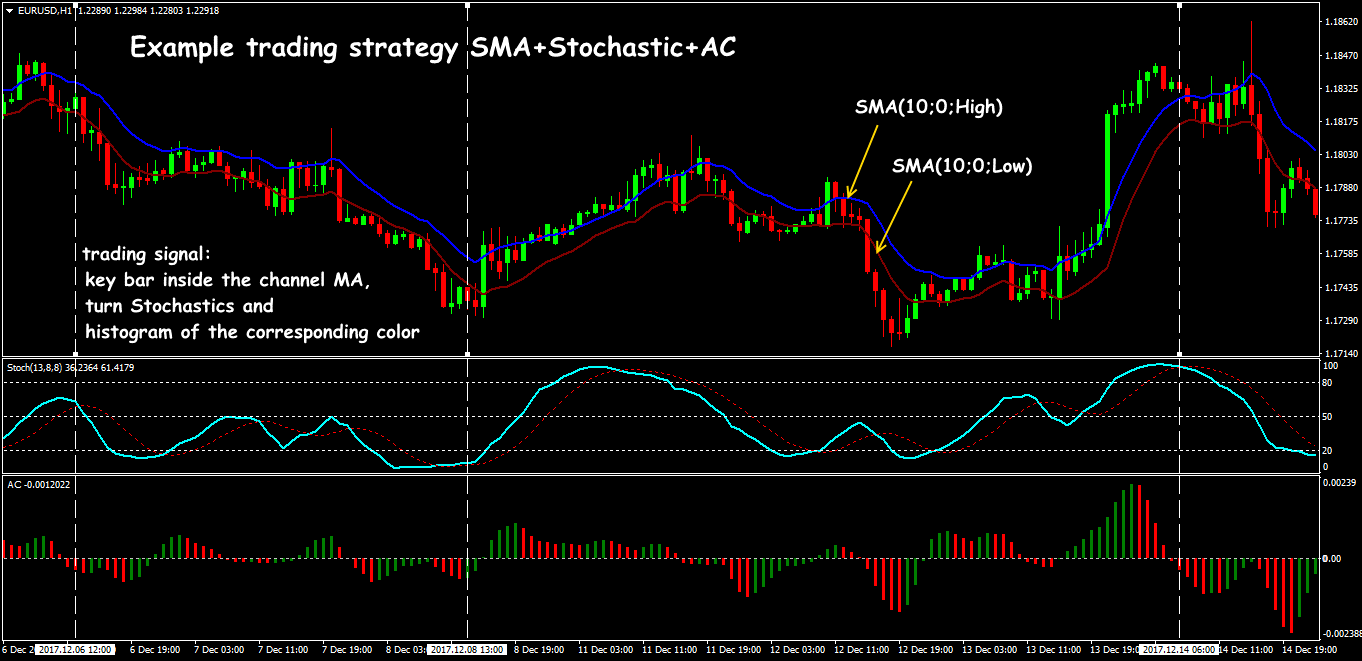

Strategy with use of the indicator

The main rule of use of Acceleration Deceleration Oscillator: to evaluate the direction of input, we must follow the color of the histogram:

- if the current bar is red − do not buy, open only SELL or are out of market;

- if the current bar is green − do not sell, only BUY transactions are allowed or not traded at all.

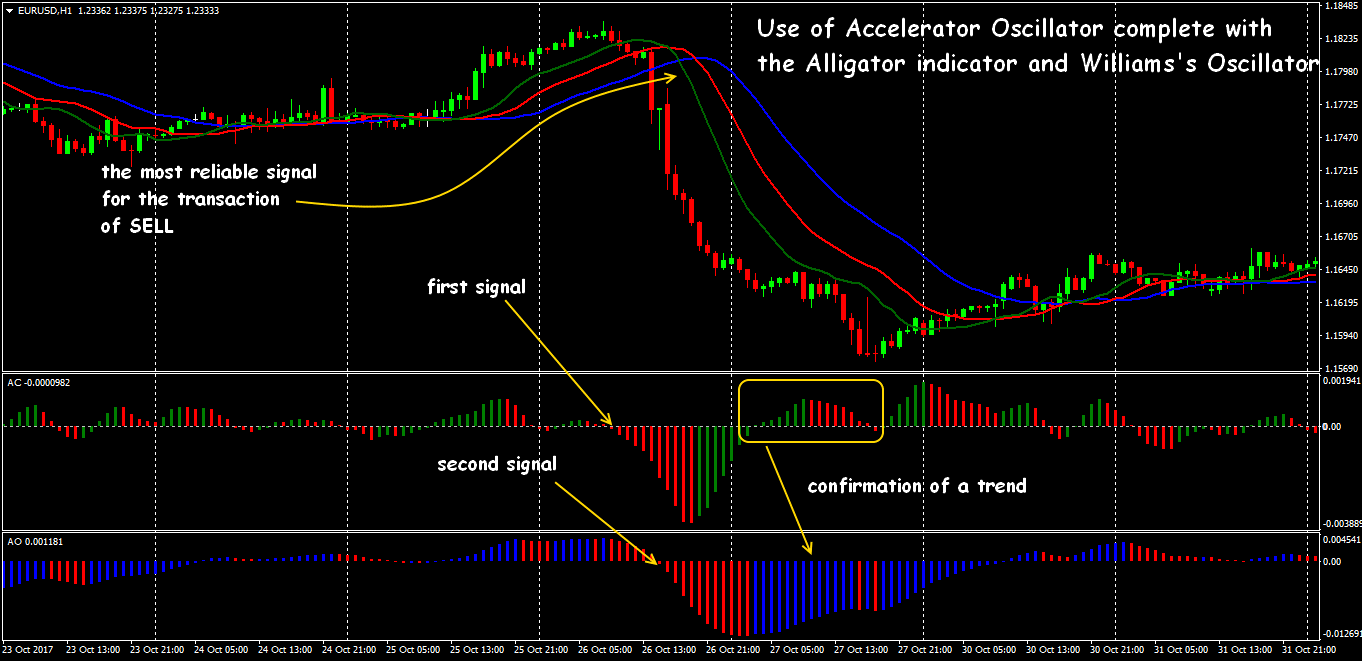

The most effective use of it in zonal trading in Williams, complete with an indicator AO and fractals, then the AC signal will be the confirmation of the main signal − the touch of the first fractal. If a signal appears on the AC indicator, but before the pending orders trigger the histogram changes color, the trading signal is canceled.

Accelerator Decelerator indicator is effective in combination with trend tools such as moving averages or Parabolic.

Acceleration Deceleration indicator can be used to assess the state of flat − during periods of low volatility, its histogram oscillates in the zero-line zone with a minimum amplitude.

Several practical notes

In any complex strategy, Acceleration Deceleration Oscillator is the first to generate a trading signal, but it needs to be used only as an additional filter. The rather complicated mathematics of indicator allows you to smooth out speculative price shots, for example, on news, which allows you to use it on any assets, even in an unstable market. Nevertheless, its signals can be considered reliable only for medium-term transactions on timeframes from H1 and higher.