Contents

- Types of breakout strategies

- Trendline breakout

- Breakout fr om support/resistance levels

- Channel breakout

- Maximum/minimum level breakout

- Volatility breakout

- Conclusions

The best forex breakout strategies are trading methods based on the price behavior in the strong trading range. Usually, after breakout, signals delay, but certain methods enable to «catch» the strong trends which lead to taking profit within a lower time frame.

Types of breakout forex strategies

Any breakout reflects reaction of the market players interested in purchase and sale. Forex breakout strategies provide a signal to enter the market alongside strong market players. If the trader makes appropriate steps, he will take a profit using a strong trend.

Depending on a type of breakout price level there exists breakout of:

- trendline;

- support/resistances zones;

- channel;

- maximum/minimum levels;

- volatility levels.

Following a forex daily breakout strategy, a reliable trade signal may be confirmed by various indicators, including volume indicators. Any breakout forex strategy requires compliance with the rules of money management, especially short-term speculative options. For that reason, breakout trading without Stop Loss is not acceptable.

Trendline breakout

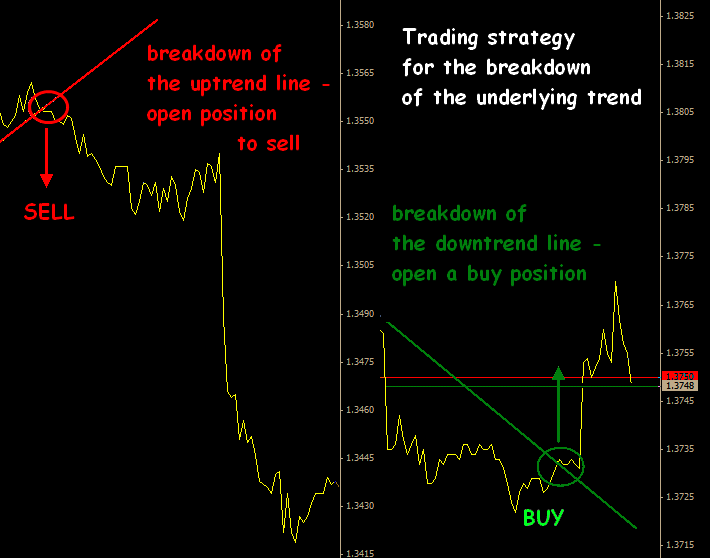

The most popular breakout forex strategy seems to be simple: a downward trendline is drawn for the «bear market», the upward trend - for the «bull market».

If the price is above the upward trend line, a purchase should be made, if it is below the downward line sale is to be done. Stop Loss is to be fixed on a trendline.

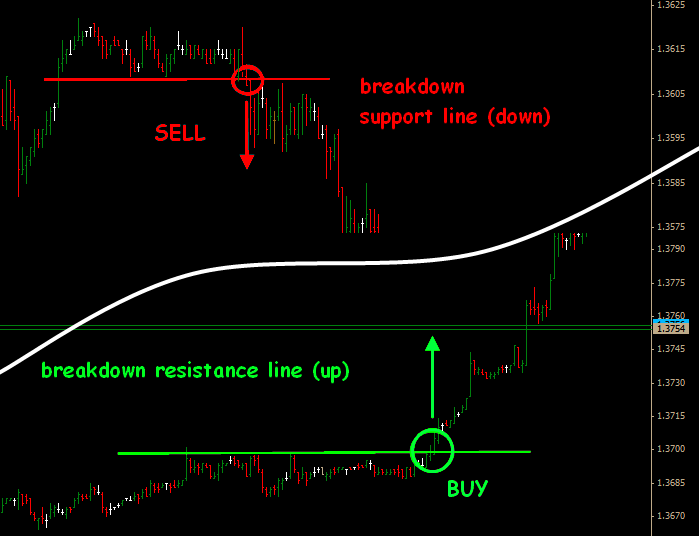

Forex strategies of breakout from support/resistance levels

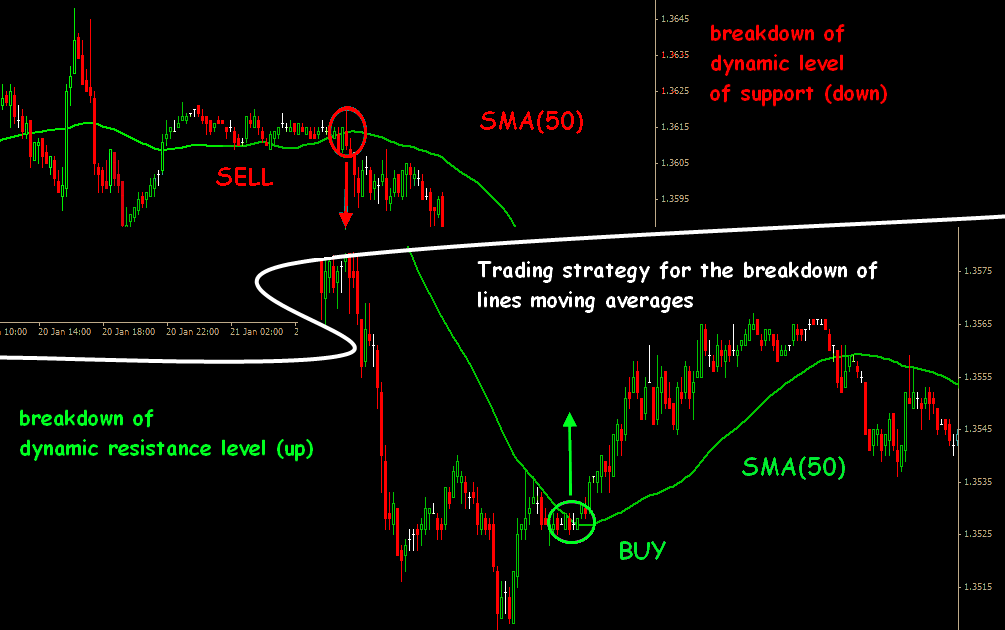

The best breakout forex strategy is the one which is focusing on trading around key price levels. Movement in strong price zone causes appearance of a large number of orders and makes an impulse to trade in certain direction. Moving averages, such as traditional SMA(20), SMA(50), SMA(200) may serve as strong support/resistance lines.

Actual breakout made after several test attempts acknowledges the existence of a strong impulse. Initial action using such breakout forex strategy is very strong, but does not always enable a trader to open up Market Order, it would rather allow to «catch» the movement.

Moreover, for a confident entry with the use of this strategy the breakout must be «true» breakdown, that should be evaluated after final candle is closed. The entry is usually made on pending orders with the Stop Loss around key levels. The principle of the dynamic level breakout underpins New York breakout forex strategy. The optimal pairs are GBP/USD, USD/CAD, timeframe М30, purchase entry - a closure of M15 candle above SMA(20) and Momentum(5) above moving average.

Channel breakout

Trend channel may be made up by static or dynamic lines which serve as support/resistance indicators. It is best advised to purchase when the price breaks out and is fixed above the bottom line of the price channel, and to sell when the price is set below the bottom line of the price channel.

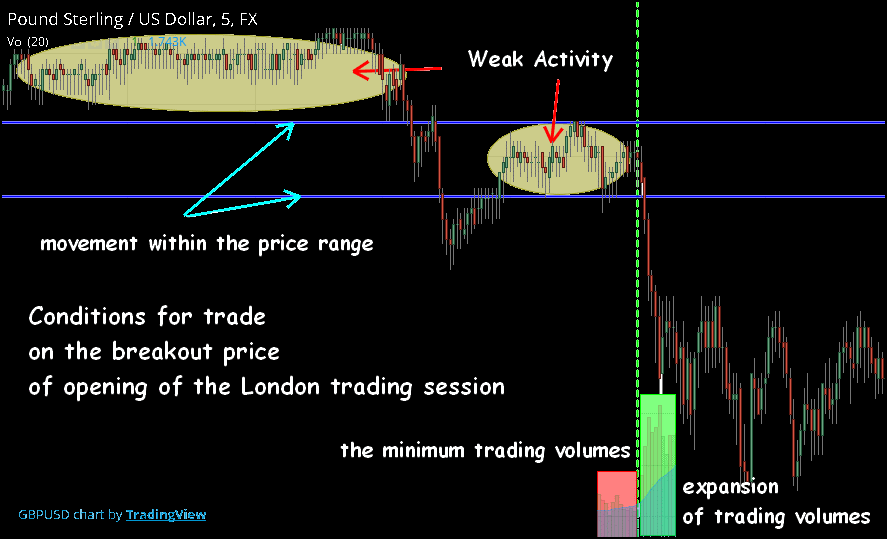

An example of forex opening range breakout strategy. Every day the market receives a large number of orders, which will start to be exercised at the opening of the largest stock exchange (Sydney, Tokyo, London, New York, Chicago). The famous London open breakout forex strategy encompasses fixing the pair of pending orders before its session is opened.

This strategy applies to EUR/USD, GBP/USD, but for the strong movement it is necessary to take into account certain requirement before the session’s opening, namely:

- Relatively calm market situation, the price set in narrow range.

- Low level of trading volumes and a large number of pending orders.

Following London open breakout forex strategy the first pair of pending buy orders should be placed within the Asian session range, while the additional pair is to be placed within max/min range of the previous day. The trader may only pick a currency pair, if he evaluates the current price position with regard to EMA (360). Stop Loss for each order - beyond the range.

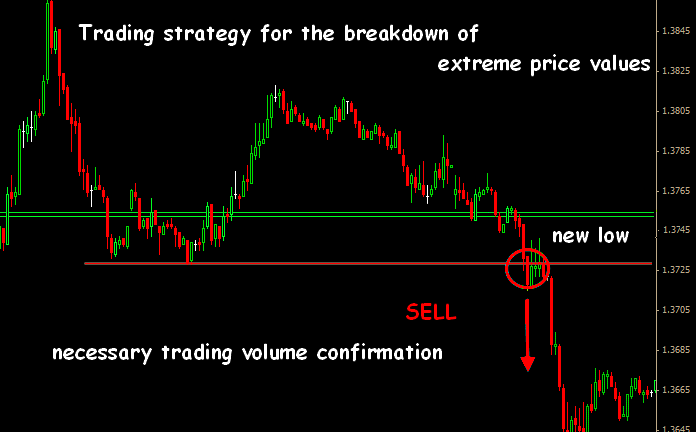

Maximum/minimum level breakout

This strategy involves a mix of the support/resistance breakout and the channel breakout. As a rule, any local extreme leads to a strong level. Renewal of max/min is considered to cause a strong trade signal in the appropriate direction.

The strategy involves a preliminary calculation of the levels of possible entry, wh ere pending orders are placed, but also an opening of the Market Order, if the price almost reaches its record. Price levels may be corrected depending on the market situation. The success of the strategy depends on the appropriate money management.

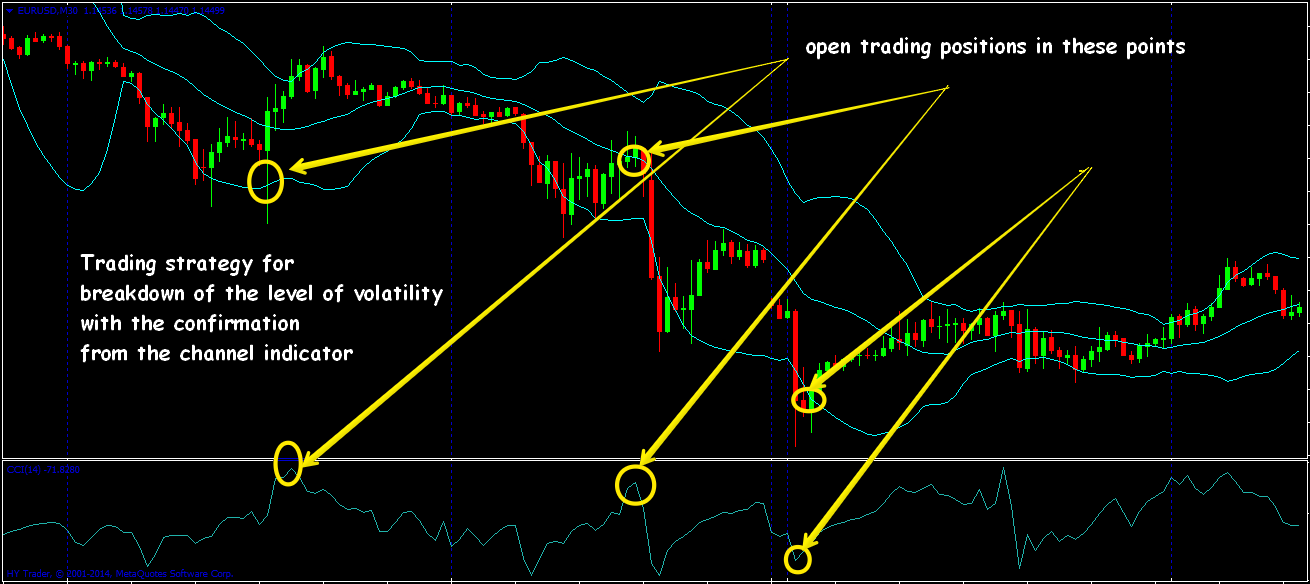

Volatility breakout

One of the best forex breakout strategies is a swing-trade. If the market moves a certain percentage from a previous price level, this leads to certain continuation of the move. This continuation may only last one day, or just 5-15 minutes, but this is still enough for taking a profit.

With volatility breakout, it is necessary to assess the price fluctuation with regard to average volatility level for certain period on the basis of Average True Range indicator. If the ATR is high, than there will be more opportunities for trend’s development. The purchase starts when the price rises above higher line of intraday volatility and sale is made when the price is below the lowest bottom line.

Conclusions

- When evaluating the breakout’s strength, the possible sliding should be taken into account. At the breakout moment, it is not advised to make an entry. The trader’s decision should be made when the breakout candle has been closed.

- Any breakout forex trading strategy must use financial asset with steady, non-speculative volatility to lower the quantity of false signals.

- Almost all forex breakout trading strategies follow the trend. Remember, that if the test of price level applies repeatedly, there increases not only the possibility of the breakout in current direction, but also a chance of trend’s change.